| RMS Queen Elizabeth 2 (#481) (Photo credit: Christopher Chan) |

QE2: Winning ETFs

Should the Fed announce another round of asset purchases as expected, it may be handy to know the following ETFs were the big winners during QE2: silver (SLV), oil equipment (IEZ), oil services (OIH), oil/gas equipment & services (XES), oil & gas exploration & production (XOP), energy (XLE), coal (KOL), metals & mining (XME), natural gas (FCG), global energy (IXC), agriculture (RJA), small cap growth (IWO), Russia (RSX), semiconductors (SMH), and private equity (PSP).

QE Script 2010

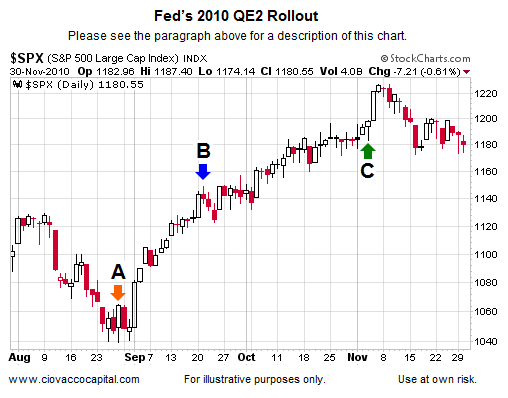

In 2010, the Fed used both Jackson Hole and a formal Federal Open Market Committee (FOMC) statement to set the table for the announcement of QE2 in November. The Fed language from points A, B, and C are summarized later in this article. Point A is Jackson Hole 2010, point B is a Fed statement that “disappointed” the markets since QE was not announced, and point C is the formal announcement of QE2. The chart of the S&P 500 allows you to see how stocks reacted at points A, B, and C.

No comments:

Post a Comment