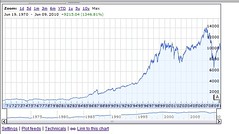

The long-term monthly chart of the S&P 500 confirms that a bull market is still in force

New York, Sep.3, stock market trading .- On Friday, the Dow Jones Industrial Average fell slightly as the possibility of a U.S.-led attack on Syria increased. And so, with the last trading day of August down, the single most-watched stock index in the world fell 4.4% for the month — its worst performance of the year.

Geopolitical tensions popped oil prices to over $107 a barrel, raising the possibility of higher prices at the pump. The impact of higher gasoline prices sent the Dow Jones Transportation Average down 1.1%.

Second-quarter GDP growth was revised up to 2.5%, which is a positive. But slower homes sales, earnings misses in the retail sector, and the threat of the Fed cutting its purchase of bonds in September kept investors on the sidelines in anticipation of the long holiday weekend.

At Friday’s close, the Dow Jones Industrial Average was down 31 points to 14,810, the S&P 500 fell 5 points to 1,633, and the Nasdaq lost 30 points at 3,590. The NYSE traded 768 million shares and the Nasdaq crossed 383 million. Decliners led advancers by over 2-to-1 on the Big Board and by 3-to-1 on the Nasdaq.

For the week, the Dow was off 1.3%, the S&P 500 fell 1.8%, and the Nasdaq declined 1.9%.

The long-term monthly chart of the S&P 500 confirms that a bull market is still in force. And as long as the black monthly line fails to drop through the red moving average line, long-term investors should remain fully invested.

However, the S&P 500 is 11.5% above the 17-month moving average, and prior market tops were made at 8.1% in August 2000 and 8.4% in October 2007. Thus, a caution flag is flying for the near and intermediate trends. Currently, the near-term trend is down and the intermediate-term is in doubt.

The recent decline from the Aug. 2 high has resulted in a correction of over 4.5% in just a month. Now, with the market oversold, both MACD and our internal indicator, the Collins-Bollinger Reversal (CBR), predict a mild rally. Resistance to a near-term rally begins at the 50-day moving average at 1,660.

Unlike the S&P 500, the Russell 2000 has broken an important support line — the upper line of the support band at 980 to 1,013. It has plummeted over 5% from its high made on Aug. 5. It is much more volatile than the S&P 500, so it could rally through both its 50-day and 20-day moving averages up to the resistance line at 1,044.

The weekly chart of the Dow Jones Utility Average indicates that following a spike in late April, and a subsequent correction, this index is now in a buy zone. As long as the index is above its major weekly bull market trendline (red dotted line), but under its 200-day moving average (solid red line), utility stocks should be accumulated for yield and growth.

Note that it has often traded below its 200-day moving average, but just once in the last three years pierced the bull market trendline. But even on that occasion in 2011, the index quickly reversed, and within a short time resumed its upward move.

Conclusion: Technical analysis is based upon the principle that humans will, under similar circumstances, react to the buying and selling of stocks much as they did in the past. So technical analysis is the study of the market itself and the reactions of literally millions of people, charting in graph form the price changes, volume, etc., and then deducing probable future trends.

Thus, the input that forms the chart is all-inclusive. By that I mean that it includes the reaction of buyers and sellers to every conceivable factor that can have an impact on a stock or index. In the longer term (months and years), it has proven to be extremely accurate. But in the time frame of days and weeks, because of volatility, it becomes more difficult to make accurate predictions.

That, however, does not mean that technical analysis is of no use for short-term forecasting. Short-term trendlines, moving averages and volume indicators are invaluable to the trader. Unlike long-term patterns, short-term patterns change rapidly and can be used along with daily events to make quick, profitable trades as long as protective stop-loss strategies are implemented.

With this in mind, I expect the market to rally this week because it is oversold in almost every respect. This oversold condition, coupled with the probability that the political and international situation has suddenly become less intense due to the surprise delay of military action against Syria, lead me to believe that buyers will push prices at least to the resistance zones illustrated in this morning’s charts.

...