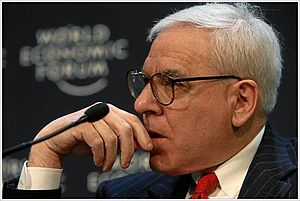

| David M. Rubenstein, Co-Founder and Managing Director, Carlyle Group, USA, (Photo credit: Wikipedia) |

Many Wall Street banks hold interest-rate sensitive products on their books, and stand to lose big if a debt crisis sends safe-haven Treasury yields spiking.

Thus far, investors have been most preoccupied by the unfolding financial catastrophe in Europe, where debate rages about whether Spain will finally throw in the towel and accept an international bailout.

Still, the threat of higher taxes and deep spending cuts loom large. The noise of the presidential election and partisan gridlock in Washington has left budget negotiations at a standstill.

Carlyle Group [CG 25.65  -0.54 (-2.06%)

-0.54 (-2.06%)  ] co-founder David Rubenstein said Friday that a short-term “grand bargain” that prevents the U.S. economy from going over the fiscal cliff was unlikely in the lame-duck session of Congress – which runs between Election Day and January 2013. Still, he thinks the next president must come to terms with the burgeoning deficit. (Read more:Investment Can Thrive, but Fiscal Fix Needed: Rubenstein.)

] co-founder David Rubenstein said Friday that a short-term “grand bargain” that prevents the U.S. economy from going over the fiscal cliff was unlikely in the lame-duck session of Congress – which runs between Election Day and January 2013. Still, he thinks the next president must come to terms with the burgeoning deficit. (Read more:Investment Can Thrive, but Fiscal Fix Needed: Rubenstein.)

-0.54 (-2.06%)

-0.54 (-2.06%)

“The most important thing the next president has to do is resolve the uncertainty of the debt and deficit,” Rubenstein said, adding that it was impossible to predict whether either President Barack Obama or Republican nominee Mitt Romney would be better for the economy.

At this point, few observers are holding out much hope for an immediate fix to the problem. Yet as the deadline looms, market observers increasingly despair that policymakers – much like the cinematic semi classic “Thelma and Louise” – may drive right over the precipice with hands locked in defiant unison.

No comments:

Post a Comment