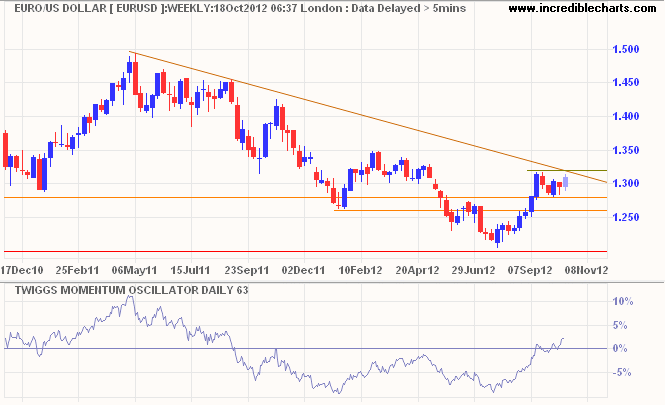

Sydney, Oct. 18, stock investment .- The Euro rallied off support at $1.28 and is headed for resistance at $1.32. Recovery of 63-day Twiggs Momentum above zero suggests a primary up-trend. Breakout above $1.32 would confirm, offering an immediate target of the 2012 high at $1.35.

* Target calculation: 1.32 + ( 1.32 - 1.28 ) = 1.36

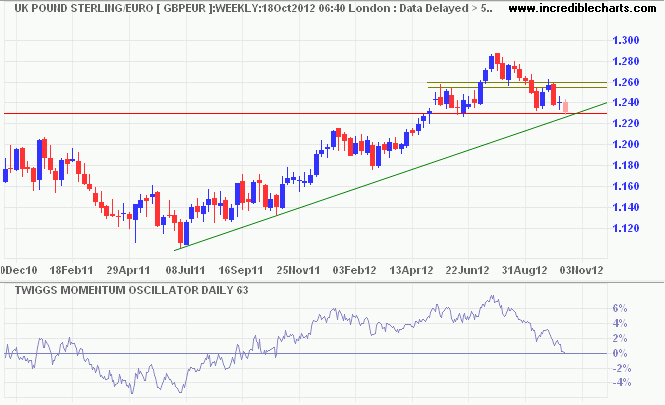

Pound Sterling is testing primary support at €1.23 against the euro. Breach

would signal a primary down-trend. Target for the completed head and shoulders

reversal would be €1.18*. Reversal of 63-day Twiggs Momentum below zero would

strengthen the signal.

* Target calculation: 1.23 - ( 1.28 - 1.23 ) = 1.18

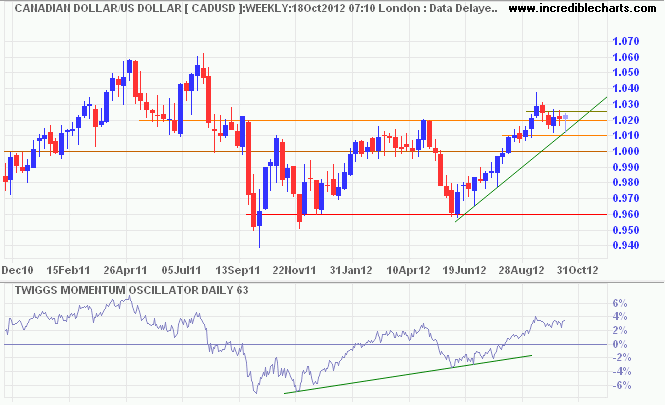

Canada's Loonie found strong support between $1.01 and $1.02 (USD). Breakout

would indicate an advance to the 2011 highs at $1.06. Rising 63-day Twiggs

Momentum strengthens the signal.

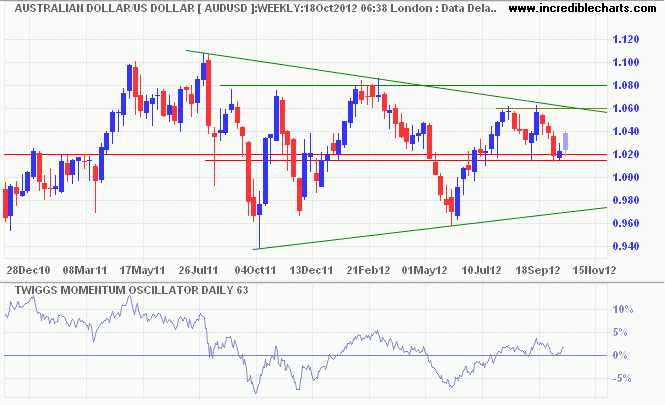

The Aussie Dollar found support at $1.02/$1.015 against the greenback. Expect another test of $1.06. 63-Day Twiggs Momentum troughs above zero indicate a primary up-trend. Breakout above $1.06 would offer a target of the 2011 high at $1.10*, though there is bound to be some resistance at $1.08.

No comments:

Post a Comment