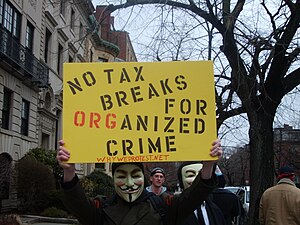

| A sign at the Boston COS protest (Photo credit: Wikipedia) |

The exemptions, which are set to expire at year's end, allow individuals to pass on as much as $5.12 million in cash, property or other assets without paying any transfer taxes. Couples can give away more than $10 million.

The current exemptions apply to the tax on cumulative lifetime gifts, which is paid by the donor, and to the estate tax. Also covered: a separate tax on assets that people give away to grandchildren and other heirs who are more than one generation below the giver.

If Congress can't reach agreement on a package of tax increases and spending cuts before the New Year, automatic increases kick in that would limit those exemptions to $1 million in assets and increase the tax rate for assets that exceed the exemption to 55% from 35%.

Even if the increases aren't triggered automatically, some observers believe that the current tax breaks won't survive negotiations as there is increasing sentiment that the wealthiest Americans should pay more in taxes.

Accountants and lawyers have been advising affluent clients for months now to consider changing their estate plans to make use of the exemptions while they still can.

Ronald Weiner, chairman of Perelson Weiner LLP, a New York City accounting firm that focuses on high-net-worth individuals, followed the advice he gave many of his clients.

At the beginning of the year, Mr. Weiner and his wife transferred a number of assets to his children, including a second home that they placed in trust.

"It's a virtual certainty that taxes are going to go up for the affluent," Mr. Weiner said.

Republicans and some Democrats want to eliminate the estate tax altogether.

But President Barack Obama has proposed raising the top estate and gift-transfer tax rates to 45%, dropping the gift-tax exemption to $1 million and lowering both the estate tax and generation-skipping transfer-tax exemptions to $3.5 million.

"If you can afford to give something away and your estate is above $3.5 million, you have look very hard at it," said David Scott Sloan, a partner at law firm Holland & Knight LLP and chairman of the firm's private wealth services practice.

For example, Mr. Sloan has been working with one couple who have a net worth of about $40 million to transfer almost one-fourth of their assets to their children.

The couple, whom Mr. Sloan described as "self-made," had paid income and capital-gains taxes on their wealth and wanted to leave as much as possible to their descendants. Their current estate plan leaves all assets to the children after the death of the surviving spouse.

Instead, by giving the children the maximum amount now allowed under the gift exemption—$10.24 million for a couple—the pair will pay no transfer taxes on the gift, and their estate won't have to pay tax on those assets, Mr. Sloan said.

Advisers warn that changing an estate plan is a major decision that can take a considerable emotional toll and may take months to complete.

Still, Georgiana Slade, a partner who heads the trusts and estates group at Milbank Tweed Hadley & McCloy LLP, said new clients continue to ask for help setting up trusts and charitable foundations to take advantage of the tax breaks.

"I've been doing this 27 years now, and without question, since Obama was re-elected, this is the busiest I have ever been," Ms. Slade said. "I effectively told my family I'd see them on Dec. 31, at 11:59 p.m." ... Continue to read.

No comments:

Post a Comment