| Downtown Albuquerque, NM, just after sunset. Features the Compass Bank building (purple), the Bank of America building, the Wells Fargo building, and the New Courthouse, plus a Carl's Jr. restaurant. Cropped a little black sky off the top in Photoshop, but the colors are as the G9 took them. This is easily my #2 Most Viewed Pic. It reached 300 Views on Dec. 23, 2007. It is also my #3 Most Interesting Pic. Congratulations! On 4 Feb 2008, it reached 500 Views! On March 6, 600! (Photo credit: Wikipedia) |

Chicago, Jan.14, stock trade .- After the fiscal cliff was resolved, at least for the moment, the S&P 500 ETF (SPY) hit a new high not seen since 2007 and money started flowing back into stocks and ETFs. According to data published last week, more than $18 billion flowed into stocks and ETFs the week of January 9th, some of the highest inflows of assets in 20 years.

Still, on a technical basis, stocks and ETFs remain stalled at significant resistance levels and will need to break higher for this rally to be sustained. Major index ETFs, including the S&P 500, Nasdaq 100 (QQQ) and Russell 2000 (IWM) are approaching short term overbought levels and so could be due for a pause or short correction, however, bullish sentiment remains strong and a break above current levels would likely lead to a sustained and possibly very strong rally.

On My ETF Radar

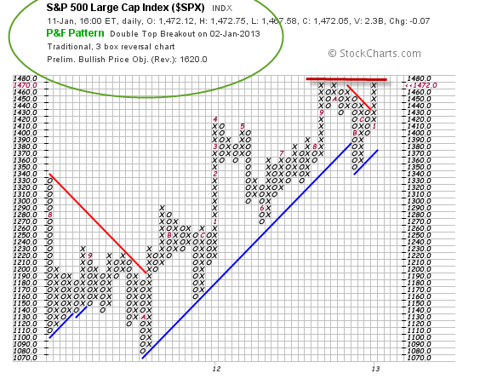

chart courtesy of StockCharts.com

In the chart of the S&P 500 above, we can see how the index and its related ETF have returned to bullish status with an upside price objective of 1620. However, we can also see how the index has stalled at the 1470 level and this is the crucial point that will have to be cleared for this rally to continue. If or when that happens, we can expect the resumption of the recent rally. Fundamental headwinds remain, of course, in the form of the debt ceiling debate and Fiscal Cliff Part 2, but the bias seems to favor the bulls at the present time.

ETF News You Can Really Use

Last week's economic reports were mixed as weekly unemployment claims jumped unexpectedly and missed expectations, however, the NFIB Small Business Index rose. Alcoa (AA) reported relatively favorable earnings to kick off earnings season and Wells Fargo (WFC) posted favorable profits that beat expectations.

For the week, the S&P 500 rose 0.4%, the Dow Jones Industrial Average added 0.4% for the week and the Nasdaq gained 0.8%.

The Week Ahead For Stocks and ETFs

Next week brings a blizzard of earnings and economic reports.

Significant earnings reports will come from the likes of JP Morgan Chase (JPM) General Electric (GE) and Intel (INTC). They will be joined by Bank Of America (BAC), Citigroup (C), American Express (AXP), Goldman Sachs (GS) and Morgan Stanley (MS) in the closely watched financial sector (XLF).

Next week will also mark the beginning of the new tax programs enacted in the 11th hour fiscal cliff deal as the tax increases start appearing in workers' paychecks. The Social Security tax holiday is now over which could reduce overall household income by more than $120 billion in 2013. Overall, the current changes are expected to trim 1-1.5% from GDP and the upcoming spending cuts are likely to add to the drag on the already sluggish U.S. economy.

Economic reports will include retail sales and Empire State Index on Tuesday, industrial production and homebuilders on Wednesday, weekly jobless claims, Philadelphia Fed and and housing starts on Thursday, with University of Michigan consumer sentiment rounding out the week on Friday.

Bottom line: The trend is turning bullish, however, significant resistance levels need to be broken for that to be confirmed. Earnings and economic reports will play heavily this week and the upcoming fiscal cliff/debt ceiling debate will return to the picture in February and March.

Disclosure: Wall Street Sector Selector actively trades a wide range of exchange traded funds and positions can change at any time. ... Continue to read.

No comments:

Post a Comment