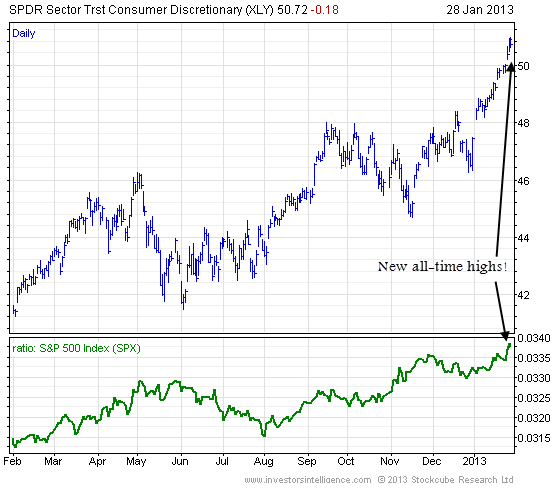

“Consumer Discretionary Select Sector SPDR (NYSEArca: XLY) made new all-time price and relative highs on Friday. Today is seeing a healthy pullback following last week’s strength,” said Investors Intelligencetechnical analyst Tarquin Coe in a note Monday. [Retail ETFs Rally on Heavy Volume]

“The fact that this area continues to break higher is a sign that the overall market is not yet ripe for a correction. If a top was at hand then this area would be printing a bearish relative divergence,” he added.

The S&P 500 continues to wrestle with the key 1,500 mark as the bulls hope for a breakout above the all-time high from 2007.

For the trailing 12 months, the consumer discretionary fund XLY is up 24.5% compared with a gain of 15.9% for SPDR S&P 500 ETF (NYSEArca: SPY), according to Morningstar.

Consumer Discretionary Select Sector SPDR

...

...

No comments:

Post a Comment