| The bitcoin logo (Photo credit: Wikipedia) |

New York, Apr.10, free investment ideas .- When was the last time you saw gold post new highs? Three months ago? Six? Maybe it was early 2012?

Nope. You're way off.

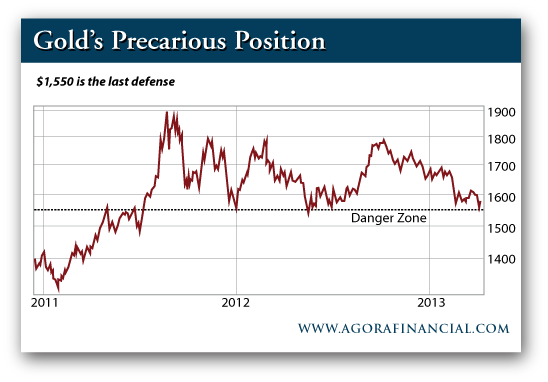

Sparked by the eurozone crisis, the August 2011 rally marks the high point for gold. If you're keeping score, that means 20 months have passed since gold has posted new highs. Sure, we've seen a few rallies (gold has failed at $1,800 three times since late 2011). But not once has gold made an honest attempt at $1,900, let alone $2,000.

Right now--while the world is smitten with the meteoric rise of Bitcoin-- the yellow metal is perilously close to another key inflection point.

|

Late last week, gold dropped briefly below $1,550 for the first time since 2012. This is the area you have to watch closely. Since gold slipped from its highs in 2011, buyers have always come in to support the price at $1,550. If this support zone fails, panic selling could send gold as low as $1,400 in a matter of weeks.

For the record, I don't see this playing out as a battle between gold and Bitcoin. While Bitcoin is a fascinating story, there's just no way flipping gold for the decentralized currency is a legit trade. I'm sure some speculators are doing it. But that's not why gold is dropping...

The simple fact is that after a 13-year run, investors are selling. Spare me your central bank stories. The market doesn't care how you feel about monetary policy right now. Selling is contagious. And right now, it's getting close to a pandemic.

Investors are selling gold ETFs at a record pace. Approximately 106 tonnes of bullion was dumped in February, according to CNNMoney. That's the biggest monthly sell-off ever. That's where your selling pressure is coming from--whether you like it or not.

The gold cycle is turning. Avoid the ETFs and miners. If you own them, get out now. These will be the most vulnerable investments as the drop approaches.

No comments:

Post a Comment