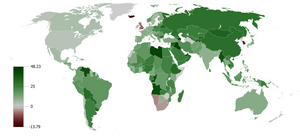

| English: Gross domestic product growth from 2007 to 2008, no inflation adjustments. (Photo credit: Wikipedia) |

Washington, May.14, stock picks .- Retail sales unexpectedly rose in April, pointing to underlying strength in the economy and leading forecasters to bump up second-quarter growth estimates. The surprise gain in retail sales, which account for about 30 percent of consumer spending, was the latest sign of resilience in an economy that has been hit by belt-tightening in Washington as the government tries to cut its budget deficit.

"It's more indication that our economy is growing. It's not growing as rapidly as a lot of people would like, but things are improving," said Tom Hall, an economics professor at Miami University's Farmer School of Business in Oxford, Ohio.

Retail sales edged up 0.1 percent after a 0.5 percent drop in March as households bought automobiles, building materials and a range of other goods, the Commerce Department said on Monday. Economists had expected a decrease of 0.3 percent.

So-called core sales, which strip out automobiles, gasoline and building materials and correspond most closely with the consumer spending component of the government's measure of gross domestic product, increased 0.5 percent after an upwardly revised 0.1 percent gain in March. February's core sales were revised higher as well.

Coming on the heels of data showing relatively sturdy job growth over the last three months, the increase in core sales helped to allay fears of an abrupt slowdown in the economy.

The dollar rose against the euro and the yen, while prices for U.S. Treasury debt moved lower. Stocks on Wall Street retreated from recent record highs, but the data helped to limit losses.

Several economists raised second-quarter growth estimates on the fairly strong core sales number. Goldman Sachs lifted its forecast by three tenths of a percentage point to a 2.1 percent annual rate, while JPMorgan pushed up its estimate by half a point to 2 percent.

The positive revisions to the core sales data for February and March initially led economists to anticipate that the government would revise higher its initial 2.5 percent estimate for first-quarter GDP growth.

However, a second report from the Commerce Department showed business inventories were flat in March for a second month, suggesting restocking was probably not as big a boost to growth in the first three months of the year as initially thought.

Even so, economists said the government's initial estimate would likely hold, given that core retail sales for February and March were stronger than earlier believed.

In addition, the lack of inventory accumulation should be a boon to second-quarter growth as businesses will likely have to stock up to meet steady demand from households.

FALLING GAS PRICES HELPING

Growth is being crimped by the end of a 2 percent payroll tax cut and higher tax rates for wealthy Americans, which kicked in on January 1. Across-the-board government spending cuts worth about $85 billion are also weighing.

But declining gasoline prices, which fell 14 cents in April, are helping to offset some of the drag on household income, freeing up money for discretionary spending.

Economists say the Federal Reserve's campaign to keep interest rates low is also helping households, in part by pushing up share prices and home values.

"Those who doubt that the Federal Reserve is making an impact just need to look at debt restructuring and wealth effects on spending," said Diane Swonk, chief economist at Mesirow Financial in Chicago. "There is no way the consumer would be holding up so well without the support of lower interest rates."

The tone of the retail sales report was mostly firm. Receipts at auto dealerships rose 1.0 percent after falling 0.6 percent in March. Though falling gasoline prices pushed down receipts at gasoline stations, sales excluding gasoline recorded their largest increase since December.

Stripping out gasoline and autos, sales rose 0.6 percent.

Sales of building materials and garden equipment supplies rose, posting their largest rise since September, a reflection of the housing market's recovery.

Receipts at clothing stores recorded their biggest increase since February last year. There were also increases in sales at sporting goods, hobby, book and music stores, and electronics and appliances stores.

Consumers also spent more at restaurants and bars.

But furniture store sales were flat and receipts at grocery stores fell. ...

No comments:

Post a Comment