| MFS Logo (Photo credit: Wikipedia) |

My top ETFs and mutual funds have high-quality holdings and low costs. As detailed in “Low-cost funds dupe investors”, there are few funds that have both good holdings and low costs. While there are lots of cheap funds, there are very few with high-quality holdings.

I think there are at least two causes for this disconnect. First, there is, in general, a lack of independent research on ETFs and funds. Second, I think it is fair to say that there is a severe lack of quality research into the holdings of mutual funds and ETFs. There should not be such a large gap between the quality of research on stocks and funds, which are simply groups of stocks.

After all, investors should care more about the quality of a fund’s holdings than its costs because the quality of a fund’s holdings is the single most important factor in determining its future performance.

My Predictive Rating system rates 7400+ ETFs and mutual funds according to the quality of their holdings (Portfolio Management Rating) and their costs (Total Annual Costs Rating).

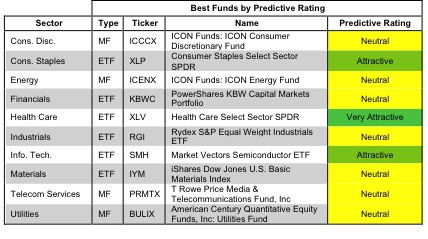

Figures 1 shows the best ETF or mutual fund in each sector as of October 8, 2012.

For a full list of all ETFs and mutual funds for each sector ranked from best to worst, see my free ETF & mutual fund screener.

Figure 1: Best ETF or Mutual Fund In Each Sector

The Health Care Select Sector SPDR (XLV) is the only sector fund to get my Very Attractive rating. XLV gets the Very Attractive rating due to the quality of its holdings. It allocates 39.44% to Very Attractive stocks and 27.75% of its value to Attractive stocks. It allocates no value to Very Dangerous stocks and only 1.63% to Dangerous stocks. This allocation coupled with a 0.18% Expense Ratio makes XLV a very attractive ETF for investors.

When you purchase an ETF, you are buying an ownership stake in a variety of businesses. XLV allocates 12.15% of its value to Johnson & Johnson (JNJ). JNJ has an ROIC of 17%, which places it in the top quintile of all companies. Usually that kind of profitability comes at a price. In this case, the valuation of JN”s stock price implies the company’s profits will permanently decline by 26%. XLV’s large allocation to a highly profitable, yet undervalued stock, exemplifies why XLV gets a Very Attractive rating. ... Continue to read.

No comments:

Post a Comment