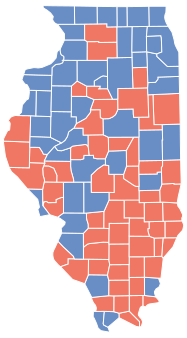

| Results of the United States presidential election in Illinois, 2008 (Photo credit: Wikipedia) |

Although Obama is ahead in all these polls, the spread is so narrow that his lead is virtually meaningless. Either candidate has a very good chance of winning.

Jeff Kleintop chief market strategist at LPL Financial, has developed his own poll, focusing on which candidate the stock market is favoring from week to week. His "Wall Street" election poll tracks the market performance of Republican-favored industries such as financial services vs. Democrat-favored industries like health care.

Kleintop's latest weekly poll as of Wednesday finds a "modest further move toward Republican-favored industries" which began after the first Presidential debate.

Democrat-favored industries such as homebuilders, construction materials and health care services suffered losses, while the Republican-favored oil exploration and production industry posted the biggest gain for the week.

Kleintop reminds readers, however, that this is an abbreviated trading week since the market was closed Monday and Tuesday due to Hurricane Sandy and stocks have moved modestly as a result.

Today stocks opened higher today following a stronger than expected jobs report which showed payrolls growing by 171,000 in October—far more than the 125,000 expected—along with upward revisions for payrolls in August and September. The unemployment rate inched up to 7.9% from 7.8%. As of 10am the Dow (^DJI) was up 18 points to 13,215 and the S&P 500 (^GSPC) up 0.67 to 1,427.

No matter who wins the election, Kleintop expects it will followed by a "divisive and bitter lame duck session" focused on dealing with the approaching tax increases and spending cuts known as the fiscal cliff.

"The negotiations themselves, coming on the heels of hard-fought election battles, can drive wide market swings and result in modest losses," Kleintop writes in his weekly market commentary.

In the lame duck sessions during the presidential election years of 1980, 2000 and 2004, stock losses range from less than 1% to nearly 4%, says Kleintop. ...

No comments:

Post a Comment