| Nuclear Power (Photo credit: EnvironmentBlog) |

Los Angeles, Jan.30, stock picks .- Last October, Dominion Resources, Inc. (NYSE: D) announced it would be closing its Kewaunee nuclear power plant. Located in Wisconsin, this small, 566-megawatt (MW) unit is the first nuclear plant to succumb to cheap natural gas.

The boom in U.S. shale gas production has natural gas prices at 10-year lows. It’s thrown an interesting curve at the domestic power market. Many utilities are retiring old coal plants in favor of natural gas. Are nuclear plants right behind?

We’ll analyze where the industry is today and where it’s going. First, let’s take a look at coal plants versus natural gas-fired ones.

Going… Going… Gone?

Many coal-fired power plants in the United States are being retired, in some cases long before the end of their useful lives. How many of the 1,169 currently operating in the United States are on the hit list?

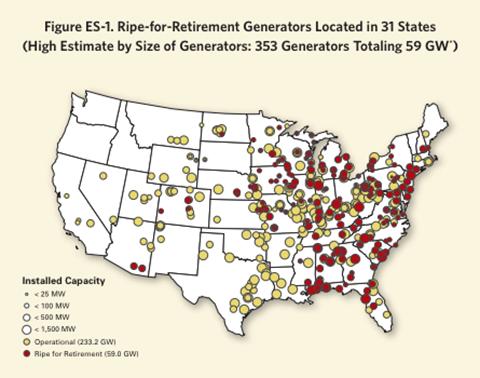

A report from the Union of Concerned Scientists entitled “Ripe for Retirement” identifies 353 of them. Check out the map below.

These plants total 59 gigawatts (GW) of generating capacity. That’s about 18% of the total coal-fired plants in the United States, and 6% of the nation’s total power generation capacity. Most of the plants on the list are older, less efficient and no longer economically viable.

The real problem is that these plants are big polluters. They’d be too expensive to upgrade to meet the latest Environmental Protection Agency’s (EPA) emissions guidelines.

The low price of natural gas in the United States is also playing a role. Utility operators have been replacing these outdated plants with newer, less-expensive natural gas-fired units. They’re also running existing natural gas-fired peaking plants more often, or even full time.

Most of the coal-fired generators that are on the retirement list average 45 years in age. That’s far beyond the typical 30-year design life for these types of plants.

Are Nuclear Power Plants Right Behind?

It’s clear from the map that coal use for power generation is on the wane here in the United States. Cheap natural gas and ever-tightening EPA emissions regulations are clearly the culprits. But are nuclear plants next? Let’s take a look.

About 20% of the power generation in the United States comes from nuclear power plants. Back in the 1960s, the Atomic Energy Commission predicted that over 1,000 nuclear power plants would be operating in the states by the year 2000.

The incident at Three Mile Island (TMI) took the wind out of the sails of the nuclear power industry. Because of TMI, plans for more than 120 nuclear plants were ultimately cancelled.

Ten years ago, there was talk in the utility industry of a “nuclear renaissance.” This was primarily due to the steep rise in fossil fuel prices and their impact on greenhouse gas emissions.

The renaissance didn’t occur here in the United States for two reasons. First, the Department of Energy has been dragging its feet with pricing carbon emissions. Second, the price of natural gas has fallen dramatically.

Construction can take four to 10 years to complete for a typical nuclear plant, and delays are the norm rather than the exception. Another factor is the price of the plants themselves. The price tag for a typical 1.1 GW nuclear plant is $6 to $9 billion. Cost overruns are always a factor, and can add significantly to the overall cost of a plant.

Compare that to a similarly sized natural gas-fired plant. It can be constructed in as little as 18 months, and on far less real estate. With regard to plant construction costs, natural gas is to nuclear as Walmart is to Saks Fifth Avenue.

The typical natural gas-fired plant can be constructed for about $1 million per MW. That puts the price for a 1.1 GW plant at just over $1 billion. This is easily within the financing range of most utilities.

It’s no wonder utilities are choosing natural gas over nuclear. It’s simply about economics.

Older, smaller plants will be the first to go. Built in 1974, the 566-MW Kewaunee plant falls into that category. Even though its operating license doesn’t expire until 2033, Dominion’s been trying to sell this plant since April 2011.

There haven’t been any takers. Consequently, the company will close the plant by the end of June 2013. It’ll cost Dominion about $281 million in decommissioning costs.

But what about the fate of the 103 other nuclear plants operating in the United States? According to data from the International Atomic Energy Agency (IAEA), 40 are smaller than one GW in size. They all could ultimately suffer the same fate as Dominion’s Kewaunee reactor.

Is There a Way to Play the Slow Demise of U.S. Nuclear Power?

The answer is yes, but not in the way you might think. You see, once up and running, large nuclear power plants still produce electricity cheaper than natural gas.

However, higher operating costs and spent-fuel storage costs are expenses natural gas plant owners don’t have. This may prompt utilities that own small nuclear plants to consider closing them.

However, higher operating costs and spent-fuel storage costs are expenses natural gas plant owners don’t have. This may prompt utilities that own small nuclear plants to consider closing them.

Still, shorting uranium miners, like world-leader Cameco Corporation (NYSE: CCJ), probably won’t pan out for most investors. The long-term global demand for uranium is projected to increase. Outside of the United States, there are 331 nuclear plants currently operating, with an additional 60 under construction.

So can investors profit as utility operators close small nuclear plants? Yes. But the way to do it is by investing in natural gas pipeline operators. Regardless of how many plants are closed, or how quickly it happens, the pipeline companies will be the beneficiaries.

Kinder Morgan Energy Partners LP (NYSE: KMP) is the largest U.S. natural gas pipeline operator. Shares currently trade just shy of $90 each. The company has a very respectable 5.8% dividend yield.

The Williams Companies, Inc. (NYSE: WMB) is another large natural gas pipeline company. Its shares trade for $35, and it pays a 3.85% dividend yield.

The majority of their business is the collection, cleaning and processing, storage and transportation of natural gas throughout the United States. They act like toll road operators, and thus get paid by the amount of product they transport. They are therefore relatively immune to price swings in the gas itself.

There’s no direct way to play the demise of either coal or nuclear-fired power plants. The two top natural gas pipeline operators mentioned above are a great way to play their replacements. ...

No comments:

Post a Comment