The S&P 500 briefly rose above the psychologically important 1,500 for the first time since December, 2007, while Apple collapsed, losing 11 percent in an earnings induced tailspin.

Apple was pummeled with no signs of bargain hunting to prop it back up, and it continued to stay at its lows in afternoon trading. The S&P 500 was flattish, while the Dow was higher. Apple is about 9 percent of the Nasdaq, which was more than a percent lower on the day.

"I would call this a very encouraging and healthy reaction—that the market's able to sustain itself without the pre-eminent player," said Jack Ablin, CIO of BMO Capital Markets. (Read More: Pros: S&P Can Rally While Apple Sputters Lower)

Can Market Rise without Apple?

On Thursday, the market surged, with the S&P topping 1500 for the first time since 2007. Apple, however, tanked. Can the rally endure without the mother ship?

Just several months ago, when Apple was flirting with $700 a share, Wall Street analysts were jumping over each other to raise price targets on the stock. It was the most widely held, influential stock in the market, and it still is the largest stock by market capitalization. Apple was described as an asset class unto itself, and even played a starring role in more than one bond-oriented fund.

But even before it's 11 percent decline Thursday, Apple erased nearly 30 percent of its gains since September. At the same time, the stock market has risen more than 10 percent since November. (Read More: El-Erian: Why Apple Isn't Driving Markets Anymore)

"It's healthy the market is not saying there are macro factors here that are influencing Apple," said one trader. "It's more of an execution problem, and it's being affected by competition."

Apple's lower-than-expected revenues were nipped by lower than anticipated sales of iPhones and Macs. Apple sold 22.9 million iPads, up about 48 percent from last year, and it sold a record 47.8 million iPhones, still below what analysts expected. Apple earned $13.08 billion, or $13.81 per share, on revenues of $54.5 billion. (Read More: Apple 'A Broken Company': Gundlach)

"It certainly was an overly invested story. It had such incomparable growth last year. it was so large that any active manager, if they didn't have five or six percent in their portfolio, they were going to trail. You needed a five percent position, even if you were neutral on the market. We've seen some funds with eight, nine, or 10 percent. It certainly was a very loved name," said Ablin.

"I think what they're trying to do is either reduce their exposure or just let the market do it for them," he said.

Ablin says the market can continue to climb higher, but may back off once March 1 approaches, the next date for Congress in the "fiscal cliff" saga. That is the day automatic spending cuts kick in if Congress does not act. Still, he sees the old high of 1565 as very achievable for the S&P 500. "It's very doable," he said. (Read More:Apple May Be 'Dirt Cheap' But It Can Get Even Cheaper)

Jeff Mortimer, director of investment strategy at BNY Mellon Wealth Management, expects the S&P 500 to surpass its all-time closing high before year end. His target is 1,575 to 1,600. He said the list of things that had worried investors are gradually retreating, including slower Chinese growth and the European debt crisis. U.S. growth is slow but there are some positives on the economic front, including housing.

"I like the fact that people are doubting. I like the fact that people are not giving credit. I like the fact the valuations are not stretched. Risky is becoming safe, and safe is becoming risky," he said.

Mortimer says Apple was like a lone commander leading the market for a while, and it's healthier that money coming out of Apple is spreading across the market. "It's much more dangerous to have one lieutenant running ahead of everyone," he said. (Read More: Investors 'Not Fair' to Apple: Cramer)

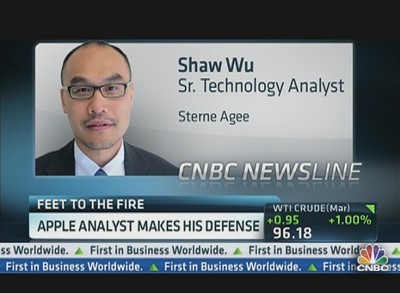

Apple Analyst Makes His Defense

How to play Apple after the stock reported Q1 earnings, with Shaw Wu, Sterne Agee senior tech analyst.

"Microsoft, Exxon, Wal-Mart—these are all names that were huge leaders that reached a certain level" before being sold off, said Mortimer. While he does not recommend individual stocks, he said the historic reaction of these former leaders could be a lesson for Apple. "Markets can go on without them…this is the norm. This is what has happened. If Apple was to go higher and higher, that would be abnormal."

Mortimer said while Apple and some of its suppliers were being sold, tech as a whole has held in. "I've used the word resilient for this market in the last seven, eight months, and it remains that way," said Mortimer. "Even when its largest member is down 10 percent….We are in a market that has been in my mind predicting too dire a future. When bad tail risk gets removed or companies report decent numbers, this is a stock picker's market now. Intel struggled after earnings, but Google and others have surprised on the upside and their stocks were rewarded."

Ablin agrees that the market has changed, and that Apple's decoupling is significant. (Read More: Apple Stops Playing Games)

"First of all, we did notice that value stocks are starting to take the lead relative to growth stocks, or financials versus techs toward the middle to end of last year," he said. "…Growth and value sytles do tend to dominate for three to five years, and I think this is kind of emblematic that we're able to take a hit in the pre-eminent growth name suggests that value investing is making a comeback."

Related articles

- For Apple's battered stock, even record revenues aren't good enough (theverge.com)

- Market Minute: Apple Results Spur Price Target Cuts, Shares Fall 9% (dailyfinance.com)

- Apple's Growth Slowdown Fuels Concern of Shift to Value Stock - Bloomberg (bloomberg.com)

No comments:

Post a Comment