|

| Image via CrunchBase |

By: Samuel Matson

Disclosure: I am long NOK.

The recent slump in BlackBerry shares (BBRY) (previously known as Research in Motion) suggests hype is fizzling as the reality of the company's challenges sets in. BlackBerry's hope hinges on its completely reinvented operating system, BlackBerry 10, that drives its brand new Z10 device. The BlackBerry 10 OS has launched to much fanfare in the UK and its home turf in Canada. However, looming ahead are the tasks of continued sales and a much needed successful launch in the US. This is the first of a two part analysis of BlackBerry 10's prospects.

In this first part, I will argue that smartphone operating systems are trending towards consolidation rather than diversification. I will then assess how this trend will affect BlackBerry 10. Lastly, I will look at one gleaming opportunity for a BlackBerry comeback.

Diversification: Cars and Computers

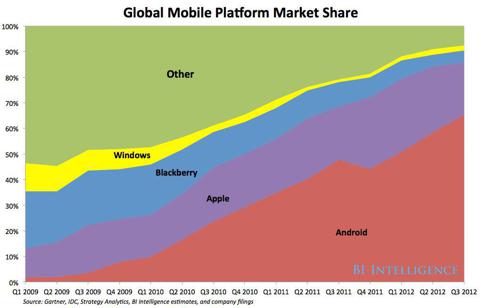

With Apple's (AAPL) iOS and Google's (GOOG) Android dominating a combined 80% of the global smartphone operating system market share, it is easy to see room for other contenders to win back double-digit percentage of sales. BlackBerry certainly needs to expand its 3% market share significantly if it plans to continue with its current business model. However, investors counting on diversification for the success of BlackBerry 10 should be wary. A closer analysis of the smartphone market reveals the unlikelihood of operating systems diversifying beyond 3 competitors.

Proponents of BlackBerry 10 point out that every industry diversifies. I have frequently heard the current smartphone market compared to the early automotive industry before it diversified. I find this a useful analogy for understanding the complex smartphone industry and will use it to supplement my counter argument.

In many ways, a smartphone is like a car. On the outside, you have a stylized protective shell much like a car body. This shell houses the smartphone's hardware, much like an automobile's engine, gas tank, axes, etc. The interface we use to control our phones might even be compared to a car's steering wheel and pedals.

If the BlackBerry Z10 device were a car, it would have a very nice steering wheel. It is BlackBerry 10's interface that has captured the attention of tech enthusiasts and investors alike. Early reviews of the Blackberry 10 OS lavish praise on the fluid and intuitive gesture commands.

So much focus is on the BlackBerry 10 interface that it is easy to forget that there is more to an OS than the gesture commands we use to control it. As the plethora of Android "skins" demonstrates, many different interfaces can be applied over the same operating system.

Fortunately, BlackBerry 10 has a few other perks. BlackBerry 10 is also very developer friendly, making it easy and profitable for developers to port their Android apps for BlackBerry 10. It is supported by BlackBerry's reputation for secure email and messaging. Lastly, it differentiates work and personal material, making it simpler for enterprises providing BlackBerry 10 to their employees, to keep their information and software licenses secure.

However, a solid product might not be enough to survive the greater industry trends opposing BlackBerry. BlackBerry 10 is being released in the fiercely competitive operating system industry that is moving towards consolidation rather than diversification. The chart below demonstrates this trend.

To understand why operating systems are consolidating, it is important to understand exactly what an operating system is.

Operating Systems Clarified

An operating system is best understood as a set of standards that determine how software interacts with hardware. To continue the automobile analogy, you might compare an OS to the set of industry standards that dictate how every automobile basically functions.

All cars share the same "operating system" and no single company owns that operating system. This enables the same parts to work in different cars and the same mechanic to fix a Ford and a BMW. This kind of standardization does not yet exist in operating systems. For example an ARM processor will not work at all with an operating system built around x86 processors. However, the PC industry has developed its own kind of standardization. Through strategic partnerships and some vicious competitiveness, Microsoft (MSFT) has monopolized 90% of PC OS market share for the past 20 plus years. While this dominance has its drawbacks, it has provided invaluable benefits as a de facto standard. For instance, Autodesk manufactured only Windows versions of its 3D CAD software for 25 years, devoting resources towards improving its complex Windows products rather than duplicating its products for Mac OS users. Furthermore, PC OS consolidation has benefited consumers by limiting the number of interfaces they must learn. Windows and Mac users develop a familiarity with their respective OS's that makes it difficult to switch.

iOS and Android dominate the smartphone industry for the same reason Windows monopolized the PC industry. Their ubiquity gives them the competitive advantage as effective standards. Android lends itself to this role particularly well. Google has made it free to license and easy to customize. These incentives have inspired at least a dozen product companies (that I can think of) to design their own variations of Androidfor products ranging from smartphones to PCs to home gaming consoles. Because of this vast product range, there will be more than 1 billionactive Android devices by October 2013, if current growth rates persist.

It seems the smartphone market has already diversified. But it has only done so by embracing Android as an industry standard, one that Google happens to own.

Opportunity Knocks

I have outlined the benefits of OS standardization for consumers and developers. The trend clearly points towards OS consolidation but only to a point. There is still room for one more competitor.

BlackBerry has been given a rare opportunity. There remains at least one group of powerful industry players that benefit from OS diversification: carriers. The big guys, like AT&T (T), Verizon (VZ) and China Mobile, don't want to depend exclusively on iOS and Android for sales. Apple and Samsung (SSNLF.PK) have bullied them into massive phone subsidies and lower profit margins. China Mobile has famously refused to carry iPhone because Apple insisted they subsidize phones, pay for advertising, and cover some of the cost of replacing malfunctioning phones. The carriers are eager to elect a third competitor in the smartphone wars and are willing to provide large subsidies and extensive advertising to shift the balance of power.

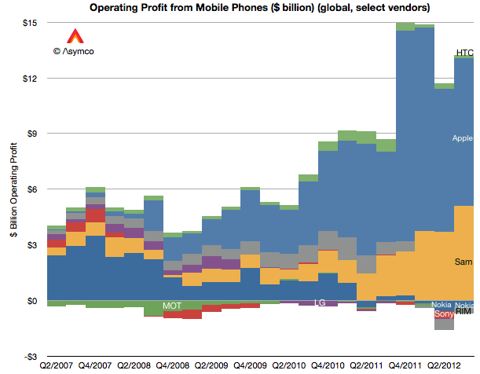

To capitalize on this strategic opportunity, BlackBerry must move fast with BlackBerry 10. AT&T and China Mobile (CHL) have already begun to side with the Windows Phone and it's unclear if they would care to lend the same support to BlackBerry. Even if they were willing to assist BlackBerry, fourth place might not even translate to profitability. The current third place contender in smartphones sales, HTC (TPE:2498), is struggling to remain in the black with profits dropping 90% since last year. Currently, any position below third is unprofitable as the chart below demonstrates.

It should be noted that HTC is an Android OEM. It does not supply its own OS and does not pay to license Android but still only turned a profit of $1 billion last quarter. For comparison, Nokia (NOK) is expected to pay Microsoft $1 billion in annual royalties in the coming years. BlackBerry's new OS adds even larger operating costs that cannot be offset by fourth place revenue.

Blackberry Needs to Thrive Not Just Survive

BlackBerry's only hope for long term growth is to assert itself into the opening provided by carriers. It currently occupies 3% of the smartphone market and has 79 million active users paying subscription fees for BlackBerry services. Some optimistic investors have speculated BlackBerry can survive by upgrading its current user base to BB10. This might work in the short term. However, estimates suggest as much as half of BlackBerry subscribers are budget customers and are unlikely to purchase the expensive new BlackBerry Z10 device. The other half of customers are by no means devout high end users either. BlackBerry lost 1 million subscribers in the past quarter. Many of its current customers are enterprises buying for employees. These enterprises might follow the "bring your own device" trends and cease to supply their employees with BlackBerry devices. Or they might simply upgrade to a different platform the way Home Depot (HD) switched from BlackBerry to iPhone. While the current user base might keep BlackBerry afloat, it is far from a long-term turnaround strategy.

BlackBerry must grow its user base, not just its short-term profits, for shares prices to stabilize. Investors will not be content with BlackBerrycontinuing with a 2% market share. The more than 150% climb in BlackBerry shares driven by BlackBerry 10 optimism could quickly be reversed if BlackBerry 10 does not show signs of long-term growth.

Summary

In summary, BlackBerry 10 has an appealing new interface and some quality features to back it up. But these merits alone are not enough to combat greater economic and industry pressures to standardize and consolidate operating systems. BlackBerry must strategically align itself within the carriers' plans to create a smartphone OS alternative. This provides a clear goal for BlackBerry. The question is, can they achieve it?

I will analyze this prospect in the upcoming part II of this article. ...

No comments:

Post a Comment