| English: A map of the 12 districts of the United States Federal Reserve system. (Photo credit: Wikipedia) |

US personal income rose 2.6% last month, the biggest increase in eight years, the Commerce Department said.

While much of the gain was due to special payments aimed at beating tax increases due to begin this month, wages still grew at one of the faster rates seen last year. That should lend support to consumer spending and provide some underlying momentum for the economy despite a surprise contraction in gross domestic product during the fourth quarter.

"Even abstracting from the one-off surge in dividend payments ... the general tone of this report was quite encouraging," said Millan Mulraine, an economist at TD Securities in New York. The increase in overall personal income was well above analysts' expectations for a 0.8% gain. However, another economic report showed an increase in new jobless claims last week, and US stocks traded lower as investors sifted through the mixed data, while prices for US Treasuries were higher.

The big rise in incomes put consumers on stronger footing entering the new year, even if the gains may not have been distributed evenly throughout the workforce. Extra dividend payments likely went to the nation's wealthier households who derive more of their income from investments.

Still, wages and salary payments grew 0.6% last month, building on a sizable 0.9% gain in November. The income gains helped push the saving rate, the amount of disposable income households socked away, to 6.5%, the highest since May 2009.

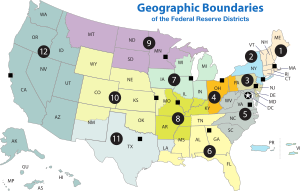

That offers a cushion for consumer spending as the temporary boost in incomes from investments unwinds and households deal with higher tax rates that took effect this month. Last month, consumer spending rose a modest 0.2%, which was just below the pace expected by analysts. The Commerce Department report also showed cooling inflation, which could help the US Federal Reserve continue easy-money policies aimed at boosting employment.

Prices rose 1.3% in the 12 months through December, down a tenth from the reading in November and well below the Fed's 2% target. A core price reading, which strips out volatile food and energy prices to provide a better sense of inflation trends, was up a tame 1.4% from a year ago.

Jobless claims rise

A separate report from the Labour Department showed initial claims for state unemployment benefits increased 38,000 last week to 368,000. However, the increase followed a week where new claims were at their lowest in five years and still pointed to an economy where employers are adding jobs, albeit at a lacklustre pace. The four-week moving average for new claims, which provides a better sense of underlying trends, gained 250 to 352,000.

A report released on Friday (Saturday NZT) is expected to show employers added 160,000 jobs to their payrolls in January after an increase of 155,000 in December. The unemployment rate is seen holding steady at 7.8%. The number of planned layoffs at US firms rose in January from the prior month, but declined from a year earlier, another report showed yesterday.

Employers announced 40,430 job cuts this month, up 24.2% from 32,556 in December, according to the report from consultants Challenger, Gray & Christmas. Layoffs were down 24.4% from January 2012. ...

No comments:

Post a Comment