Boston, Feb.28, daily stocks .- Just a few weeks ago, the financial media's obsession with all-time highs was impossible to ignore. Now, just one week into a corrective move, the stories have turned to panic about a new and powerful bear market on the horizon.

Have we lost our minds? Maybe...

Or perhaps this is simply a case of over-analysis. Right now, there's a tug-of-war between pundits who are calling for a market top and those who see the market grinding to new highs. We're at an important market inflection point this year--so I doubt this debate is going to disappear anytime soon.

But right now, we cannot allow this debate to paralyze our analysis. Here's what the market is telling us this morning:

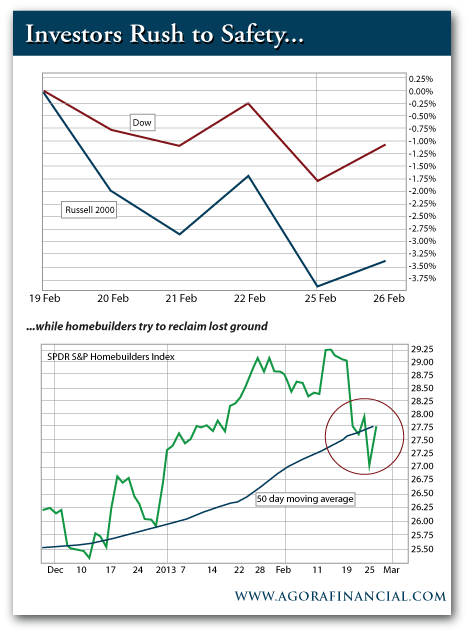

Investors want safety. They're ditching high-flying small-cap stocks in favor of blue chips and defensive sectors. You can see the strength of the Dow compared to the Russell 2000 over the past week as proof...

|

Another bright spot is the homebuilding sector. New homes sales released yesterday hit levels not seen in more than four years. This helped bump sagging homebuilder stocks back to their rising moving average. Strong follow through this week will indicate that this sector is back on track.

Now that you have a couple of key spots to watch, let's take a look at a landing zone for this pullback...

Back on Feb. 8, I told you about the extreme reading on the insider sell-to-buy ratio. When the sell-to-buy ratio has hit these extremes in the past, the broad market dropped an average of 2.1% over the next month.

At the time, I told you a 2% move lower would be right in line with a reasonable pullback after a strong January rally. So far, we're following that script.

The S&P has fallen about 2.5% from its peak one week ago. That puts its February losses just above 1%. Another push lower here wouldn't be out of the question.

No comments:

Post a Comment