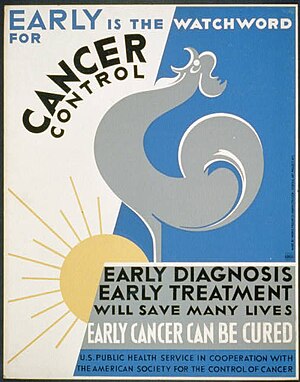

| English: Poster promoting early diagnosis and treatment for cancer, showing a rooster crowing at sunrise. (Photo credit: Wikipedia) |

Chicago, Feb.7, swing trading .- To this day, it was the most horrible sight I'd ever seen.

A close family member on a ventilator, suffering from lymphoma that had spread to his lungs. An intricate surgery had not succeeded. He would not get out of that room or off the ventilator until the last day of his life, when he went to hospice, four months later. Despite how tough it was to see, I didn't have the luxury of letting my emotions go. That was reserved for his children, wife and mother. In fact, they asked me to visit to try to cheer everyone up. With all of the family in the room so depressed, I put on a mask of cheerfulness and tried to have a normal conversation (as normal as you can have with someone on a ventilator) about business (his favorite topic) and current events. His teenage son massaged his feet to help the circulation.

Cancer sucks.

Nearly everyone has lost someone to cancer and knows someone fighting it right now.

There are roughly 200 types of cancer, which is when cells divide and multiply unstopped. They eventually take over organs and other parts of the body that provide critical functions.

Scientists across the globe are committed to trying to eradicate the disease, lengthen survival times and ease suffering. And although we're nowhere close to "curing cancer," huge advancements have been made. Certain types of cancer, if caught early enough, are no longer fatal.

And it's a huge business.

According to The American Journal of Managed Care, Americans spent approximately $125 billion on cancer treatment in 2010 - double the amount from 20 years earlier.

The top three best-selling cancer drugs in 2011 - and five of the top 10 - were all sold by Roche Holding (OTC: RHHBY). In 2012, Rituxan, Avastin, Herceptin, Tarceva and Xeloda brought in $22 billion in revenue.

Small biotechs and large pharmas dream of creating drugs that will be the next Avastin - a drug that will help patients, bring in billions in sales and boost its stock price.

Drug and biotech companies - The most obvious and the most speculative. If you own the right small company that gets a drug approved and has a successful commercial launch, the returns can be spectacular. Celgene (Nasdaq: CELG) and Onyx Pharmaceuticals (Nasdaq: ONXX) both had drugs approved in December 2005. Their stocks have tripled since then. An investor can try to find the next Onyx and Celgene, small companies that become big winners. Or they can stick with larger pharma and biotech companies like Roche, with proven drugs and business models. My personal favorite large pharma with a meaningful oncology presence is today's Investment U Plus recommendation. (Its latest and greatest success is the first and only drug to improve melanoma patients' survival.)And shareholders of those companies dream of newfound riches as the stock price soars on increased earnings, revenue and speculation of new effective treatments.

There are many ways to invest in healthcare companies that help cancer patients:

There are many ways to invest in healthcare companies that help cancer patients:

- Medical devices/tools - On the more conservative side is a company like Intuitive Surgical (Nasdaq: ISRG). Its da Vinci system allows doctors to surgically remove tumors in a less invasive procedure than typical surgery. Intuitive Surgical generated over $2 billion in revenue last year and has been profitable for nearly a decade.

On the far more speculative side is a company like Delcath Systems (Nasdaq: DCTH). Its Chemosat device saturates the liver with chemotherapy to treat liver cancer. This bypasses the rest of the body and enables more medicine to treat the cancer, making it less toxic to the patient. It has not yet been approved in the United States.

- Ancillary drugs - These are drugs that do not kill the cancer, but make taking the often-toxic cancer drugs easier. For example, GlaxoSmithKline's (NYSE: GSK) Zofran helps ease the nausea associated with chemotherapy. TEVA Pharmaceutical's (NYSE: TEVA) Fentora and Actiq treat cancer pain.

- Diagnostics - With advancements in the study of genetics, there are now tests that can direct physicians to certain types of treatment based on the genetic mutations of the tumors. For example, Genomic Health (Nasdaq: GHDX) has a test for breast cancer that can tell a doctor whether the tumor is likely to react to chemotherapy. If it won't, the patient and doctor can choose another course of treatment, avoiding wasted time and the side effects of chemo.

No comments:

Post a Comment