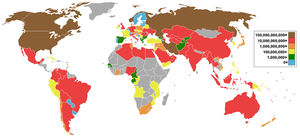

| Natural gas production by countries (Romania in red) in cubic meters per year (Photo credit: Wikipedia) |

Chicago, Mar.26, stock stock .- The boom in new oil and natural gas flowing through U.S. pipelines is beginning to ripple through the wider American economy. Just ask Edrick Smith. In September, Smith traded temp agency jobs for full-time employment with Baltimore-based Marlin Steel Wire Products, which makes wire baskets for industrial customers. An experienced machinist, Smith is now expanding his skills by learning to set up and operate factory robots.

(Read More: Bakken Oil Field May Be Even Bigger Than Estimates)

"Knowing each and every machine in here gives me an opportunity to make good money, and to educate myself more," he said. "This is my career."

Smith's hiring was just one of thousands of openings created indirectly by a new boom in domestic oil and natural gas drilling - a bounty so rich that it has even caught energy industry insiders by surprise. In part 2 of our four-part " Power Shift " special report, we examine how the explosion in drilling in places like North Dakota and West Texas is spreading through the general economy - despite controversy over the potential environmental impact of the new industry practices.

Marlin Steel Wire, for example, has expanded its payroll and invested in high-tech equipment to keep up with a steady pick-up in orders from other U.S. manufacturers. Orders are rising, said owner Drew Greenblatt, because his customers are receiving a widening discount in the price of natural gas and electricity.

"That's making U.S. companies that used to be at a price disadvantage now uniquely positioned to win contracts they never won in the past -- or haven't for a while," he said. "Everyone talks about what's going on in North Dakota, but it's filtering down now to conventional factories throughout America."

"This is not going to be a one- or two-year thing," said Ross Eisenberg, head of energy and resources policy at the National Association of Manufacturers. "We're going to see lower natural gas prices for a long, long way into the future."

Booms, Busts and Booms

Since the first gusher of oil spewed from of the ground above the Spindletop salt dome outside Beaumont, Texas, more than a century ago, the U.S. energy industry has enjoyed its share of booms and busts. After peaking in the early 1970s, U.S. oil and gas production began to decline as thousands of depleted wells were shut down. The U.S. rapidly became dependent on foreign suppliers to fuel its economy.

About a decade ago, advanced oilfield production technologies like hydraulic fracturing, or "fracking ," and horizontal drilling began to reverse that trend. Many of the now-bountiful fields being brought back on line were mothballed long ago when the remaining "tight" oil and gas deposits were considered too costly or technically difficult to produce.

"It is a sizeable opportunity," said John Larson, an economist with IHS Global Insight. "It's a game changer."

The economics of production have also played a role in the boom. A tripling in the market price of a barrel of crude over the past decade supports widespread use of costly extraction methods that didn't make sense when energy prices were lower.

Barring an unanticipated setback, so-called "unconventional" oil and gas production is expected to continue to grow over the next two decades. Over that period, the industry is expected to make more than $5 trillion in new capital investment that will support more than 3.5 million jobs by 2035, according to the financial analysis firm IHS Global Insight.

That economic impact of such spending already is spreading, especially to companies that rely heavily on natural gas as a raw material or energy source and investing and hiring.

Steel makers, for example, benefit from both the lower cost of manufacturing and from strong demand for steel pipe used for oil and gas drilling. Companies in the steel rustbelt of Pennsylvaniaand Ohio are polishing up aging plants to replace coal with cheaper natural gas. Others are setting up shop closer to major gas distribution hubs like Louisiana , where steel giant Nucor (NUE) is investing $750 million to fire up a new plant later this year.

Chemical, plastics and fertilizer makers, who rely on natural gas both as a raw material and an energy source, have also been expanding production. Last year, Dow Chemical (DOW) announced a $4 billion investment in facilities, part of some $15 billion in expansion plans announced by Gulf Coast chemical makers. And Vancouver-based Methanex (Toronto Stock Exchange: MX-CA). decided last year to spend $425 million to disassemble an idled methanol plant in Chile and move it lock, stock and pipeline to Louisiana .

In December, economists with UBS (Swiss Exchange: UBSN-CH) bank tallied some $65 billion in announced construction of new plants related to cheaper natural gas, and said another 11 plants had been announced worth billions more.

(Read More: Finding an Edge in the Booming US Energy Market )

As groundbreaking on these projects gets under way, the dividends from the energy boom will flow even further - to construction companies, engineering firms, materials and equipment suppliers and lenders who help finance the projects.

That, in turn, will help shore up state and federal budgets. The added revenue - from income taxes on new jobs created, corporate taxes on added oil and gas profits and state and federal royalty payments - could top $2.5 trillion through 2035, according to IHS Global Insight.

Though prices at the gas pump have remained stubbornly high -- primarily because stepped-up U.S. production makes up relatively small percentage of the global supply, which drives oil prices -- American households are also getting a big break on the lower cost of natural gas and electricity. Larson, the IHS economist, estimated that the energy "dividend" amounts to about $1,000 a year per household and will double by 2035.

"It's a fairly substantial return of wealth to the American consumer," he said.

Increased U.S. oil and natural gas production also promises to help rebalance the long-running trade gaps that have weakened the dollar. If the U.S. moves from a net importer to a net exporter of energy over the next decade, as some experts project, oil will flip from being a source of trade deficits to an important contributor on the positive side of the ledger. With China 's energy-hungry economy expected to continue to rely on imported oil, some analysts believe Beijing may soon begin swapping its huge pile of U.S. Treasury bonds for barrels of West Texas crude.

America's growing energy independence also has been fueled by gains in efficiency: U.S. vehicles are squeezing more mileage from every gallon of fuel, and high-tech heating and cooling units and green building techniques and materials have cut energy bills for commercial and residential buildings by 10 percent since 2005.

Challenges Remain

To be sure, there are forces that could delay - or even derail - the ongoing energy boom. The drop in natural gas prices has already slowed production of some projects that become too costly when gas prices are too low.

Lower oil prices could have the same impact, but it's not clear that added U.S. supplies will be sufficient to make a dent in global oil prices, especially if OPEC producers like Saudi Arabia throttle back on supplies to maintain current prices.

But some experts are more bullish on the prospects for a second energy windfall as increased U.S. supplies of oil rein in global prices. Citibank analyst Edward Morse thinks that by the end of the decade, added U.S. output will pull global crude prices back down to a range of $70 to $90 a barrel - a savings of as much as 30 percent.

That kind of price drop would further amplify the economic boost from lower natural gas prices already flowing through the economy.

Last year, for example, the U.S. consumed roughly 7 billion barrels of oil at an average price of about$100 a barrel . A 30 percent discount on that oil bill works out to about 1.3 percent of gross domestic product. In an economy growing at roughly 2 percent a year, the impact of that dividend would be substantial.

Other factors could slow development. Widespread environmental concerns about the impact of hydraulic fracturing on water supplies have delayed drilling of the Marcellus shale field in New York, where the state Assembly recently voted to extend a moratorium for another two years. In California, the state Legislature is considering at least eight bills to regulate expanded production in the Monterey shale field, estimated to be one of the largest deposits in the country.

Oil and gas producers also face a looming labor shortage as a generation of petroleum engineers and geologists approach retirement age. Their departure is compounded by a dearth of trained younger workers to take their places. From a peak of 11,000 students enrolled in geology and petroleum engineering programs at 34 universities in 1983, only 1,500 were enrolled in 17 programs by 2004, according to a 2007 report from the Interstate Oil and Gas Compact Commission.

(Read More: Energy Boom Dawning in America )

Finally, transportation bottlenecks have already slowed the distribution of new energy supplies and could further slow future expansion. Expanding the existing pipeline network, which was planned and constructed decades ago, long before new drilling techniques rewrote the U.S. energy map, is already raising safety and environmental concerns.

The most visible controversy - construction of the proposed $7 billion Keystone pipeline through the nation's heartland - could be the opening round of ongoing local battles over the build-out of the network required to get new supplies of oil and natural gas from producer to consumer.

"We imported natural gas this winter to the Northeast because we don't have the capacity yet to move the gas where we need it," said Larson. "As a country, we need to address the issue of how we develop the infrastructure we need to enable this energy to flow to where it's needed." ...

No comments:

Post a Comment