Boston, Mar.1, online stock trading .- Late last year, gold investments were flying high...

December marked a new record in gold holdings by popular exchange-traded funds. Spot gold hovered around $1,700. The 12-year golden bull appeared alive and well.

That's where the trouble started.

Some analysts believe gold has become too tradable with the invention of ETFs that offer investors exposure to the physical metal. With ETFs, momentum traders can easily gain exposure to physical gold and hop right off if they don't like the ride.

And now that we've seen the first signs of a gold sell-off, evidence is mounting in favor of lower gold prices in the coming weeks and months.

One of the market's inconvenient truths is that one wave of selling can inspire countless other investors to run and hide. The same herd mentality that pushes prices skyward can also send them crashing down. That's true of anything you trade on an open market--even gold.

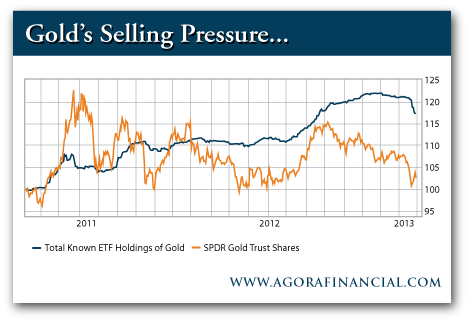

This selling pressure has revealed itself through these easily-tradable ETFs. Total known ETF holdings of gold-- a metric tracked by Bloomberg--has plummeted this month along with the price of the physical metal.

Take SPDR Gold Trust Shares. The world's largest gold-backed ETF is working on its biggest monthly outflow since its inception in 2004...

"As a gauge of investor interest, holdings of the SPDR Gold Trust... fell around 2.5 tonnes from the previous session to 1,270.44 tonnes on Feb. 26, in its sixth session of decline," reported Reuters earlier this morning. That's a lot of supply flooding into the market...

I already warned you about gold's initial sharp decline from $1,650. At this point, I do not see how gold can quickly recover its momentum. Look for additional wild price swings over the next few weeks.

If you own one of these big gold ETFs, it might be time to hit the road.

No comments:

Post a Comment