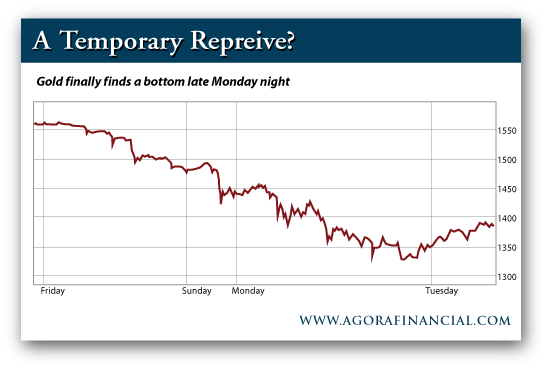

Baltimore, Apr.17, stocks to watch .- The horrifying news out of Boston distracted me from the markets for a few hours yesterday... I didn't see gold break below $1,350 shortly after the stock market closed. And I didn't watch it bottom at $1,320, only to move higher overnight. Instead, I was watching for updates on the bombings and thinking about the victims and their families. I know you were probably doing the same.

So what did you miss?

As I mentioned, gold finally crash landed...

|

So far, gold's big move lower is following our rough draft outlined in yesterday's issue. Today's gold rally above $1,350 could very well trap the metal in the $1,350 - $1,450 range. We've seen the initial panic. Now, it's time for denial to set in. Expect sharp moves in both direction as gold attempts to "settle in" at these levels.

Still, I expect lower prices from here. If you're keeping score, my long-term price target near $1,000 stands.

But what about the market? You know, stocks?

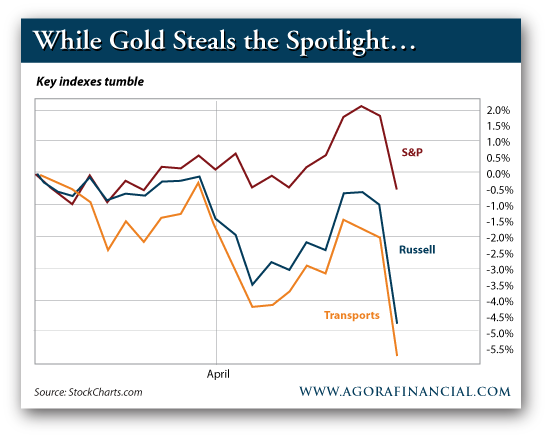

While everyone was distracted yesterday by gold or the news, equities fell hard...

|

The S&P cratered more than 2%. The Russell 2000 and the Dow Transports-- two groups that had flashed warnings signs just a couple of weeks ago--both dropped more than 3.8%. Both small-caps and transports look like they're rolling over. Last week's rally didn't top the March highs. As of yesterday afternoon, prices are back to where they were in late February...

So far, the market action we're seeing this month rhymes with the past couple of years. This tax day selloff could very well be the beginning of the spring pullback you've been waiting for. If you missed getting in on the post-fiscal cliff rally, you will have a chance to buy soon enough as stocks shuffle sideways or correct.

If stocks are indeed temporarily caught in gold's downdraft, we should see them break free of one another as the impact of gold's drop begins to wane. If stocks begin to march higher as gold drifts, you'll know it's safe to test the waters.

No comments:

Post a Comment