| Gold Key, weighing one kilogram is used to access a ten digit account number which is known only to the bearer of the Gold Key. (Photo credit: Wikipedia) |

Chicago, May.11, hot stocks .- I was expecting a relatively quiet morning. I was wrong.

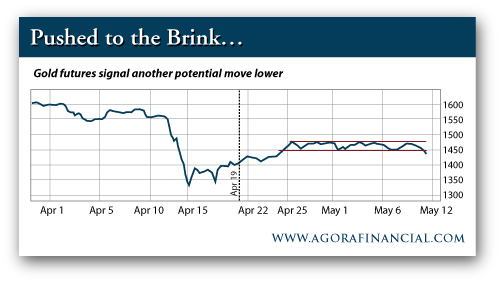

As I was compiling my notes earlier today, gold futures started to tumble.

Since mid-week, price has fallen from the high $1470s to the $1,420s. These are levels we haven't seen since April 25.That's when gold began trading in a nice, orderly horizontal channel. Just a couple of hours ago, it broke through its price floor on strong volume. Not a good sign if you're a gold bull… Here are two important takeaways from all of this: First, it's important to note that the consensus opinion amongst the chart watchers has been that gold would probably have a fairly mundane summer. I've generally agreed with this position. Aside from a little volatility here and there, I was expecting gold to wander sideways for some time after its massive drop. Clearly, it has other plans. You have to adjust your thinking here and prepare for the possibility of another leg lower. Next, the recent action in gold is a great lesson on dip buying—or buying any asset just after it takes a nasty fall. "Buy when there's blood in the streets" is one of the most misunderstood investment axioms ever. Every asset needs time to recover after a crash. I'm talking about a significant amount of time—not just a few days or weeks. At this point, too many investors are convinced gold can move higher from here. You'll want to buy when everyone agrees that gold is cooked. To paraphrase the great technician Walter Deemer: When it's time to buy, you won't want to... |

||

No comments:

Post a Comment