| English: (Photo credit: Wikipedia) |

Los Angeles, May.1, stock market trading .- Right now, I feel a bear rising from its slumber. And I've gotten pessimistic on one market in particular... U.S. oil.

I can't spell it out any clearer.

It is time to protect energy positions with a short on oil.

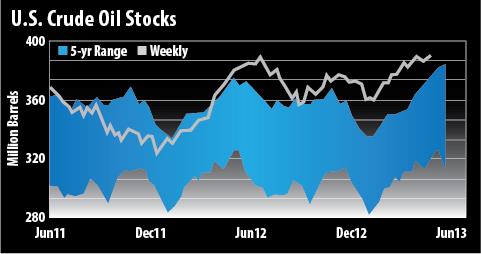

The days of $100-a-barrel crude are winding down (barring some major supply chain disaster). U.S. stockpiles of crude are at multidecade highs. Stockpiles are more than 4% higher compared to this time last year - and the five-year average was already way out of whack.

The average futures price for U.S. crude for the week ending April 19 was $88.33. That's a far cry from the $103.97 average we saw during the same time in 2012.

And those lower prices are being felt over at Big Oil...

The second-largest oil company, Chevron (NYSE: CVX), saw revenue decline 4.5% in the first quarter.

And even though Exxon Mobil (NYSE: XOM), the largest oil company in the United States, saw earnings rise in the first quarter... the boost was primarily due to lower taxes and its chemical business. Exxon's revenue, on the other hand, fell 12% due to lower oil prices.

Now throw into the mix weakening economic data from the United States, a slowdown in China, the increasing likelihood of an ECB rate cut coming in the days ahead and a softening global economy.

And all this is happening against the backdrop of rising U.S. crude oil production, which is expanding at a breakneck pace.

To expect prices to remain above $90 a barrel is overly optimistic.

Putting the Pedal to the Metal...

Let me put it in perspective for you: Crude oil production throughout the United States is 20% higher this year than in 2012. Meanwhile, our imports of foreign oil continue to slide, down 14% year-over-year.

Not to mention that U.S. crude oil stockpiles are just under a 23-year high, while U.S. crude oil production is at a 21-year high. And demand isn't expected to increase significantly anytime soon.

Take a look at the thin gray line on the chart... When it heads north, chances are oil prices will head south:

Earlier this month, the U.S. Energy Information Administration reduced its global oil consumption projections by 12%, from 1.14 million barrels per day (originally forecast in March) to 1 million barrels per day currently.

And even more telling, the rise in oil production expected this year from non-OPEC nations (primarily North America) will outpace the projected increase in global oil demand. That means added production from fields like the Bakken, the Eagle Ford and the Canadian oil sands - which will see a combined increase in output of 1.06 million barrels per day - will offset any growth in worldwide demand.

Tracking the Trend

Over the last few years, we've seen U.S. oil prices generally peak in late April and early May. Then they moved down significantly in the summer and fall. Check out the seasonal data below:

That's an average of a 23.7% drop in the price of oil over a handful of months...

So what does the table tell me? It says the fundamentals - and the technicals - are all going against higher oil prices at this point.

And the situation doesn't appear set to change anytime soon. Just look at the number of rigs. Right now, 78% of all rigs in the United States are drilling for oil.

And the trend shows no sign of abating.

Baker Hughes reported that the number of rigs drilling for petroleum increased by 10 in just the past week. And the number of rigs drilling for oil in the United States is up 53 from the same period in 2012, a 4% increase.

But this is a massive shift from four short years ago...

Back then, natural gas was the thing. In late 2008, 80% of all the rigs in the United States were drilling for natural gas. A mere 413 platforms were going for oil.

- By January 2010, there were 427 rigs drilling for oil in the United States.

- By the first week of January 2011, there were 777.

- By the same period in 2012, there were 1,191.

- And by the first week of January 2013, there were 1,318 rigs in the United States drilling for oil.

And yet...

U.S. oil demand hit a 16-year low for the month of January. February, in fact, saw the lowest oil demand in 20 years. And petroleum consumption in March was down 1.3% from last year.

You see where I'm going with this... the near-term picture for U.S. oil prices is about as negative as one can imagine. ...

No comments:

Post a Comment