| Summertime Blues (Photo credit: Wikipedia) |

Boston, Jul.2, free investment ideas .- Summertime.

It was the inspiration for musical talents such as George Gershwin, The Zombies, Billie Holiday, Sam Cooke, Miles Davis, and thousands of others who covered Gershwin's Porgy and Bess aria, as well as original, modern-day odes to the lazy glory of warm weather by Fresh Prince and DJ Jazzy Jeff, and Sublime.

Gershwin sums it up best in what's probably one of the most recognized lines ever written: "Summertime and the living is easy..."

School is out. The fish are jumping... The grill comes out from hibernation. The days are sunny and hot. Dreams (and realities) of tropical places - sitting on the beach, sipping some fruity cocktail - dance through everyone's heads.

It's a time that makes all the cold, miserable days of winter seem worth it.

Unfortunately, it's also the time of the year the markets start suffering from lethargy and losses... And a lot of that has to do with everyone focusing on enjoying the weather and living their lives.

Hot Weather and Negative Return

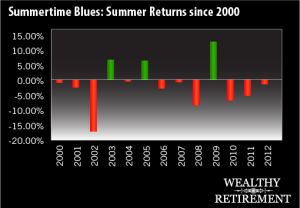

The May to August stretch since 2000 has been filled with red. Let's take a look at how the S&P 500 has performed during that short span...

There were some bright spots in 2003, 2005 and 2009... But most of those were rebounds following major financial catastrophes.

Since the start of May, the S&P is up 1.6%... But June started to show some weakness as volatility came back into play. The VIX rose 50.36% from May 1 to June 24 before trailing back down.

Will the S&P finish the stretch from May to August in negative territory? History says it's more likely than not, even though we're up at the moment.

So where should we look for some safe investments during the summer lull?

"Gen" to Spare

A couple weeks ago, I wrote that beer companies enjoy their prime periods for profits during the summer months. In Emerging Trends Trader, our play on this seasonal brewer boom has set a new 52-week high in each of the last three weeks... And has vastly outperformed the negative return the broader market has offered.

One of the other sectors I start looking at this time of the year is biotechnology.

During the stretch from August to March, the NYSE Acra Biotechnology Index (^BTK) has outperformed the S&P 500 nine times from 2000 to 2012...

That means, only four times during the last 13 years, the broader market outperformed the biotech sector. It's not completely fail-proof - but few things in investing are.

Better yet, the average overall return for the biotech index is nearly 500% higher than the S&P 500.

We could be selective and pick some strong companies from the biotech index.

It's made up of strong names with three powerful biotech letters - "gen" - such as Amgen (Nasdaq: AMGN), ImmunoGen (Nasdaq: IMGN), Biogen (Nasdaq: BIIB), Regeneron (Nasdaq: REGN), Celgene (Nasdaq: CELG), Myriad Genetics (Nasdaq: MYGN) and Illumina (Nasdaq: ILMN), as well as a dozen others.

Or we could target an exchange-traded fund (ETF) like First Trust NYSE Arca Biotech Index Fund (NYSE: FBT), which tracks the same index.

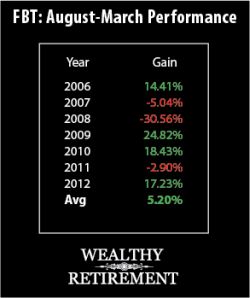

FBT has performed almost equally strong as the index it follows from August to March since its inception in 2006...

But what if the economy gets as bright and sunny as the weather? What if the "summer lull" this year is only what we experienced from the latter half of May into June?

Then there's no reason to really worry... And biotech should continue to outperform the broader market.

Everything has been on a tear in 2013 for the most part. We've had more than two dozen sessions where the Dow has gained over 100 points.

And the biotech sector has been undeniably strong as well, with FBT gaining 18.54% since March. That's more than double the 7.28% on the S&P during the same stretch.

Plus, if we look back the historical performance of the biotech index versus the S&P from August into spring, when the broader market was strong, biotech was stronger... When the broader market was weak, biotech was still stronger...

No comments:

Post a Comment