Gauss is the newest portfolio launched (12/27/2011) here. While the annualized performance is a respectable 25%, it still lags both the VTSMX and ITA Index benchmarks as it took time to populate all 15 equity and bond asset classes. The broad market was in a positive mood during the launch phase and as a result, the portfolio fell behind the benchmarks.

Instead of looking to the past, what are the forward projections for the Gauss based on Quantext Portfolio Planner (QPP) analysis? To answer this question, I stretched out the analysis period to 53 months so as to include all of the last bear market and to make sure every ETF had complete historical data. Moving out to 60 months would have corrupted the analysis as a few ETFs do not have five-year histories.

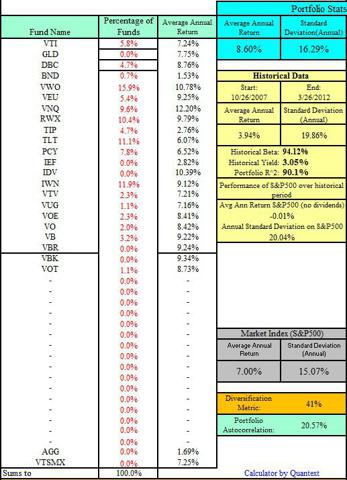

QPP Analysis: In the following screen shot, the current ETFs and the percentage they occupy in the portfolio are listed below. The percentages were updated this morning just after the market opened.Platinum readers will recall there are goals set for the Strategic Asset Allocation plans for each portfolio.

- The projected annual return is to exceed the projection for the S&P 500 by one percentage point. This portfolio is projected to best the S&P 500 by 1.6% points.

- The projected standard deviation should come in under 15%. The Gauss does not meet this standard. However, the Gauss is one of the ITA Risk Reduction candidates and we plan to hold down portfolio uncertainty by using the ITARR model. For this reason, we are less concerned about the 16.3% SD projection.

- The Diversification Metric is to exceed 40%. The Gauss meets this goal.

- The desired Portfolio Autocorrelation will be something below 20%. The Gauss is close. This metric is the least important of the four.

There are several ETFs included in the list where we do not currently hold any shares. Those ETFs are held for historical purposes or are place holders for possible investments in the future.

Click to enlarge

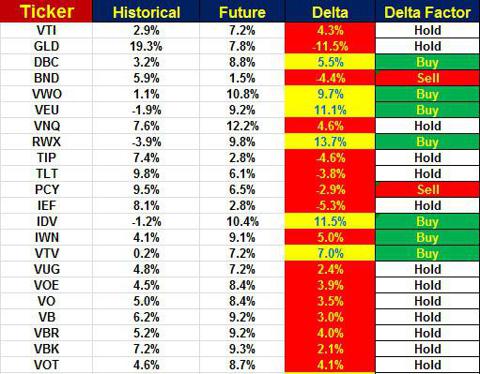

Delta Factor Projections: In the data table below, we find the "Delta Factor" projections based on 53 months of historical data. The reference for bond and treasury ETFs is AGG while the benchmark for the equity oriented ETFs is Vanguard's VTSMX.

Even with the current market as high as it is, there are still some opportunities for investment. VWO is one and I added a few shares of emerging markets to the Gauss over the last month. VEU is another commission free ETF that merits attention. As readers will see, the Gauss is invested in all the important asset classes as all the individual ETFs are priced above the current 195-Day Exponential Moving Average.

No comments:

Post a Comment