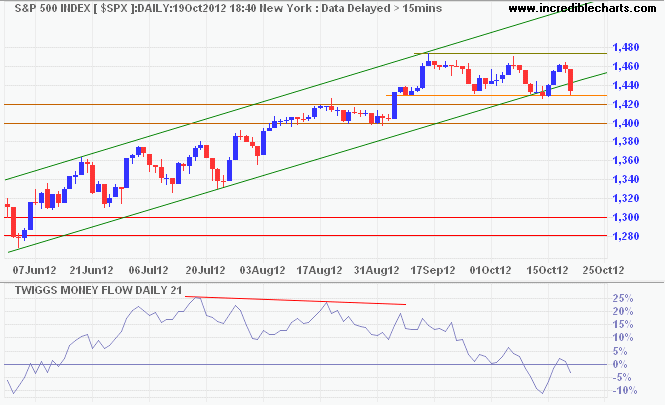

Sydney, Oct.22, trading stocks .- Disappointing quarterly earnings from Google, Microsoft, Intel, IBM and McDonald's over the past week led to a sell-off on Friday. The S&P 500 is again testing support at 1430. Reversal of 21-day Twiggs Money Flow below zero warns of renewed (medium-term) selling pressure — a peak below zero would strengthen the signal. Breach of 1430 would signal a correction; follow-through below 1420 would confirm.

* Target calculation: 1420 + ( 1420 – 1280 ) = 1560

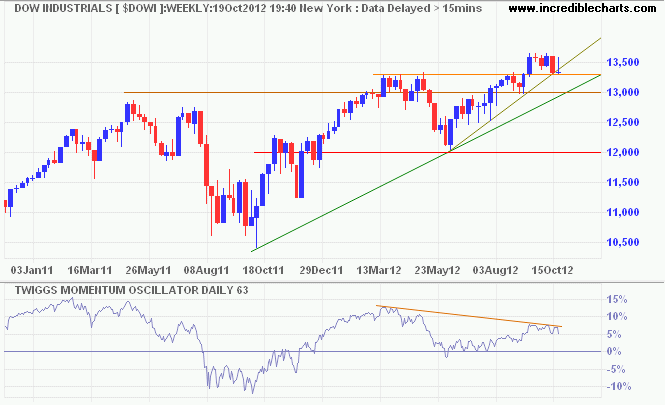

The Dow Jones Industrial Average is similarly testing support at 13300 (weekly chart). Bearish divergence on 63-day Twiggs Momentum indicates a weakening up-trend, and reversal below zero would warn of a primary down-trend. Reversal below 13000 and the primary trendline would suggest that a top is forming. Recovery above 13650 is unlikely but would indicate an advance.

... Continue to read.

No comments:

Post a Comment