| English: American investor Jim Rogers in Madrid (Spain) during an interview. Español: El inversor norteamericano Jim Rogers en Madrid (España) durante una entrevista. (Photo credit: Wikipedia) |

New York, Feb.7, hot stock picks .- At the 2013 ETF Virtual Summit, investment guru Jim Rogers pointed out the growing need to expand and diversify an investment portfolio with commodities. Specifically, Rogers recently highlighted the rising growth story in China.

“In my view, China is going to be the most important country in the 21st century,” Rogers said on The Daily Ticker.

Putting his money where his mouth is, Rogers moved to Singapore in 2007 as a way to help his two daughters grow up speaking Mandarin Chinese.

While he is a staunch China bull, Rogers cautions that China’s growth “is not going to happen overnight or straight up,” pointing out that the U.S. had its setbacks over the 20th century and China will likely experience some growing pains as well. [Jim Rogers Benchmarks Guide Commodity ETFs]

Rogers is not proclaiming that the U.S. will see an immediate downfall, and any new positive economic data won’t shake his negative U.S. outlook.

“The U.S. is the largest debtor nation in the world while China is the largest creditor nation in the world,” Rogers added. [China ETFs See Huge Demand Amid Rally]

Investors who are interested in gaining access to the Chinese markets can take a look at a number of China related ETFs, including:

- iShares FTSE China 25 Index Fund (FXI)

- SPDR S&P China ETF (GXC)

- iShares MSCI China Index Fund (MCHI)

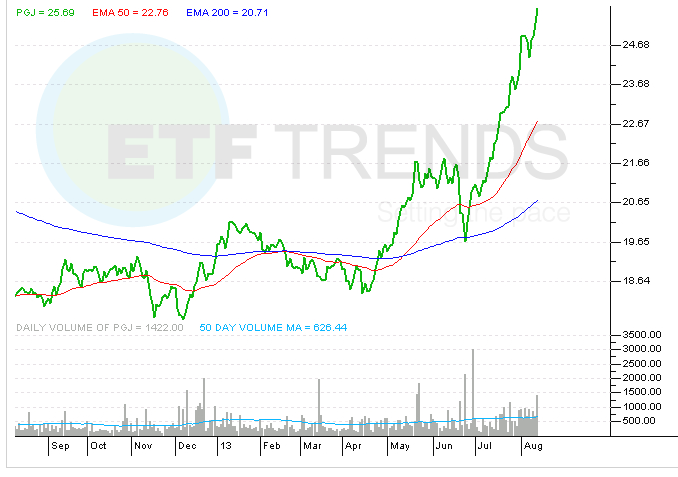

- PowerShares Golden Dragon Halter USX China Portfolio (PGJ)

- Guggenhiem China All-Cap Fund (YAO)

- Market Vectors China A-Shares ETF (PEK)

- iShares FTSE China Index Fund (FCHI)

SPDR S&P China ETF

No comments:

Post a Comment