| Old NY Times Building (Photo credit: Wikipedia) |

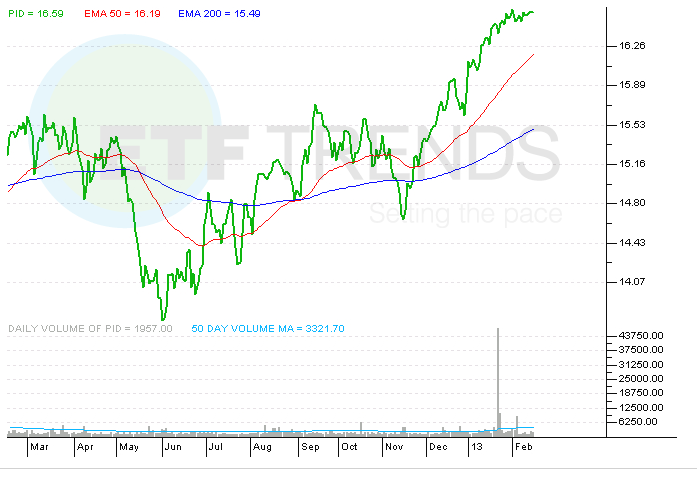

New York, Feb.20, stock investment .- International equities continue to offer decent valuations compared to U.S. stocks, making the case for investing in overseas dividend exchange traded funds stronger.PowerShares International Dividend Achievers (NYSEArca: PID) holds quality companies with minimum volatility, and is recommended by investment researcher Morningstar.

PID is “one of our favorites for its quality focus and relatively low volatility,” Abby Woodham wrote for Morningstar. “Instead of chasing the highest yield available like many of its competitors do, PID targets durable companies by employing quality screens.” [Special Report: Surveying the Dividend ETF Landscape]

PID is known as an international counterpart to popular U.S. dividend ETFs such asVanguard Dividend Appreciation (NYSEArca: VIG), Woodham notes.

PID yields about 2.59%, and is a more conservative play than the higher yielding dividend ETFs. The portfolio consists of both growth and value companies, and weights by dividend yield. Due to this methodology, the ETF does exhibit some rough patches should the market turn volatile. Since higher yielding dividend companies are not favored during uncertain times, they can trade at a steep discount from their fair market value, explains Woodham. [Top International ETFs for Dividends]

Furthermore, the search for high yield may have pushed higher yielding ETFs to a premium, however; the dividend ETF as a category trades at 15 times earnings versus 14 for the SPDR S&P 500 (NYSEArca: SPY). Advisors find much to recommend in high-yield stocks, but they urge investors to be selective and to judge companies by more than the amount of cash they dispense, reports Conrad De Aenlle for The NY Times.

“In order to find a good dividend-paying company, you have to go beyond the dividend,” Robert Shearer, manager of the BlackRock Equity Dividend fund, said in the report. A company has to have sufficient profits not just to pay the latest dividend, he explained, but also to expand the business so that it can pay future dividends, preferably in successively higher amounts. “If companies don’t have cash to invest in the business,” he said, “they won’t have it to grow dividends, either.” [These Dividend ETFs are Globetrotters]

PID offers up the best risk-adjusted performance among its peers, showing less volatility than competitors and a better total return. PID also outperformed the MSCI EAFE Index over all time periods since the 2008 financial crisis with less volatility, reports Woodham.

“It makes sense to take a global perspective,” Robert T. Lutts, chief investment officer of Cabot Money Management, said in the NY Times report. “There is less potential for price disappointment because the companies are involved in diverse economies and have strength in their industries.”

PowerShares International Dividend Achievers

No comments:

Post a Comment