| English: Stijn Claessens speaking at the Cass Business School in London. (Photo credit: Wikipedia) |

New York, Feb.25, trading stocks .- Global emerging market (GEM) small-cap ETFs offer investors very different portfolios than the widely held benchmark GEM ETFs. By eliminating large-cap companies from their portfolio small-cap GEM ETFs give investors less exposure to cyclical resource and export driven companies and less exposure to state-owned/directed enterprises.

Instead, small-caps ETFs give greater exposure to companies that are driven by domestic demand like consumer-related companies, industrials, real estate and financial services. This is positive and makes small-cap ETFs an important consideration, especially for investors in the market cap weighted GEM ETFs like Vanguard FTSE Emerging Markets (VWO) and iShares MSCI Emerging Markets (EEM), which favor large companies.

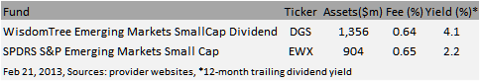

GEM Small Cap ETFs

There are two GEM small-cap ETFs to consider. WisdomTree Emerging Markets SmallCap Dividend (DGS) uses a similar indexing methodology as its sister fund WisdomTree Emerging Markets Income (DEM). DGS' portfolio is indexed according to valuation, dividend contribution and demonstrated growth of dividends. The portfolio then selects the smallest 10% market cap companies from this methodology for its portfolio. As a result, DGS features the highest yield in the category (4%).

DGS is a diversified portfolio with over 600 holdings and the largest single equity weight is 1%. The portfolio over-weights Taiwan and smaller emerging Asia countries like Thailand and Malaysia. Sector over-weights include consumer goods, industrials and IT. The fund also has its largest exposure to financial services firms, which is common throughout emerging markets. Banks and financial services should be beneficiaries of growing demand for credit, insurance and other financial services as markets mature.

State Street SPDRS S&P Emerging Markets Small Cap (EWX) uses a traditional market cap and free float based weighting methodology that selects companies below the $2bn market cap threshold. Its portfolio has high financial services, consumer and IT exposure. Its country orientation over-weights Taiwan (27% of assets), driving the high IT sector exposure, and has a much larger position in China (18%) than DGS. The fund is diversified and deep like DGS.

Liquidity is good, access is unique

Both funds are liquid trading around $5-10m/day. What is also unique about the small cap funds relative to the benchmark GEM funds is that direct access to small-cap emerging market companies is difficult for ordinary investors, whereas many large-cap companies list ADRs directly on U.S. stock exchanges. For example, I can buy six of EEM's top-10 holdings on the U.S. exchanges in ADR form - Taiwan Semiconductor, Petrobras, China Mobile, Vale, America Movil and Itau Bank. Samsung and Chinese state banks being the notable exceptions.

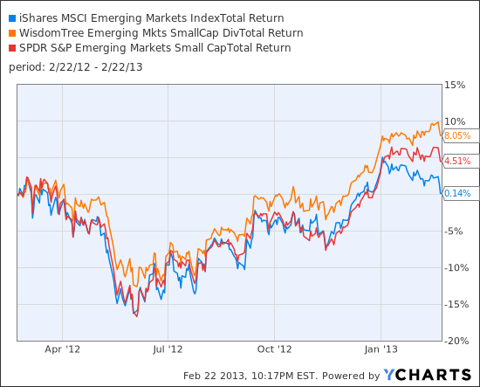

DGS has outperformed EWX and broader EM

A look at performance shows WisdomTree's DGS delivering the best return over the past 12 months outperforming both EWX and benchmark GEM fund iShares MSCI Emerging Markets .

Small cap funds face challenges in tracking their index due to liquidity constraints in the underlying shares. This is an unavoidable caveat. Nonetheless a total returns comparison still factors this in.

Get more small caps in your portfolio

I believe exposure to smaller-cap emerging market equities is crucial for investors in the GEM asset class. Benchmark funds like EEM and VWO favor large companies, which include many mega-cap resource exporters and state-directed enterprises. Many of these companies depend on global demand trends and government policy over domestic-driven growth trends.

Prefer DGS

Of the two ETFs I prefer DGS. Both funds are deep and diversified. Both give exposure to domestic-demand-driven sectors, and both have Taiwan and financials as top country and sector exposures. EWX's greater exposure to China and Taiwan make the fund more cyclically driven however. Volatility will likely be higher in these funds since small caps typically trade at higher valuations. DGS' fundamental dividend oriented strategy, and lower exposure to China, should mitigate some of the volatility and support returns over time. ...

No comments:

Post a Comment