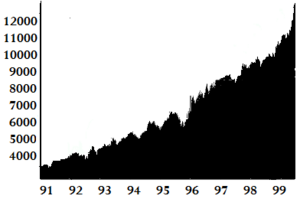

| English: The Dow Jones Wilshire 5000 approximates the shape of the rise in the DJIA during the 1990s acceleration. (Photo credit: Wikipedia) |

Chicago, Feb.23, stock tips .- Success can come at an early age. That might be because the youth are not saddled by the biases and emotional baggage carried by the old.

“I make over 64% per year on my investments,” says Rachel Fox in the fifth episode of her video series, “Fox on Stocks.” And she’s not keeping her success a secret. She’s willing to tell you how she does it.

Fox is a 16-year old stock picking phenom, as Eric Fry alerted us last week in The Daily Reckoning. A compulsive day-trader using technical analysis, she’s already finished high school, so she can just wake up and trade.

However, she is also a working actress. She’s best known for playing the sociopathic Kayla Huntington on Desperate Housewives a few years ago. She’s appeared in a number of series and movies and has even been nominated for some acting awards. And if that’s not enough, Fox is also a singer and she produced her own album.

Ms. Fox must have a few extra hours in the day so she has created a website about investing, where she shares her investment wisdom. She’s such a hot commodity she was interviewed last week on CNBC’s “Squawk on the Street.”

The camera loves her.

In an interview with Daniel Sparks of Value Folio, Fox said what makes her a good trader is that her Zodiac sign is Leo. “So, I’m as fearless as I come. When I get an idea in my head that something is going to happen, I just go do it — nobody can tell me otherwise. That’s a really good thing to have.”

The words of Graham and Dodd or Jack Schwager have not clouded her judgment. She told Sparks:

| “I should be a better reader of books, but I am just not. I read a lot of scripts, blog posts, and stuff on Yahoo Finance. But I definitely think there are lots of books I’d like to read, especially to get a psychological perspective on trading. But at the same time I try not to intake too much information. If you intake too much of the wrong information it could clog your head with the wrong stuff. It’s better to keep a clear vision and go with your gut.” |

Two of her prominent themes: trade instinctively and don’t get emotionally attached to the stocks you trade. What she means is that you shouldn’t take stock tips from someone else and you should forget about knowing what’s going on with a company; just trade it based on whether it’s overbought or oversold. “Trade in the dark,” she says. From the mouths of babes...

When she attributes her stock trading success to her zodiac symbol or what part of the year she was born she sounds like a silly 16- year old girl. But forming your own opinions and not falling in love with the stocks (and their stories) is actually sound advice.

Ms. Fox learned with her first trade that tips from strangers about $2 “sure things” going to $10 are a sure-fire way to lose. Next, being emotionally attached to a stock will keep you from buying or selling a position when you should.

This is all relevant because the Dow Jones Industrial Average (DJIA) is approaching a level it hasn’t seen since 2007 and the average guy is starting to become interested in shares again.

“This bull market has strength and legs,” said investment pro Jim Stack earlier this month. “Right now, it’s the same position we had last year, if not even stronger. I don’t know if we’ll have another 16% gain, but I wouldn’t rule out a double-digit gain for 2013.”

Likewise, Stocks For the Long Term author Jeremy Siegel figures this bull market has a ways to go and sees the DJIA hitting 15,000 to 17,000 by the end of this year. During an interview, the talking heads on CNBC challenged his bullishness, rightly pointing out that stocks have gone nowhere for a decade.

Siegel responded that stocks went nowhere for a decade because they started with a 30 times P/E (price earnings ratio). Now, the market P/E is 14, slightly below the historical average of 15. So its “full speed ahead” according to the Wharton School professor.

Some talking heads say the economy is getting better, so stocks will keep going up. Others say that increased stock prices foretell a strong economy? Whatever. Neither is right. Mark Skousen explains as much in his book Investing In One Lesson. He says that a company’s ongoing business has little to do with its stock price, and stock prices day-to-day have little to do with the direction of the economy.

Skousen writes, “With a publicly traded company, price and value are no longer the same. The money game on Wall Street is no longer the company business on Main Street. And that fact can lead to some rather perverse effects...”

So should investors be jumping in and out of stocks? Josh Brown of Fusion Analytics doesn’t think so. “I know people who play market timers on TV,” he says, “but in reality it’s a very tough game to play.” He says just buy and hold. And he’s not alone in that assessment.

Vanguard’s Jim Bogle agrees, as does his friend Warren Buffett, whom Bogle quoted as saying, “When the dumb money realizes how dumb it is and buys an index fund, it becomes smarter than the smartest money.”

I wonder if these two old geezers would have the heart to say that to Ms. Fox.

In the book What I Learned Losing A Million Dollars, authors Jim Paul and Brendan Moynihan point out the emotional traps that lead to stock market losses — amplifying Ms. Fox’s wisdom. While individuals rarely feel invincible by themselves, when a crowd forms, people feel powerful. In the market, this means a crowd of opinion.

You can be part of a crowd sitting by yourself in front of your computer screen. Watching the ticker symbols that you have a rooting interest in as they scroll by on CNBC, Fox Business, or Bloomberg can hypnotize you if you’re not careful.

“In the special state of fascination (contagion),” write Paul and Moynihan, “an individual is in the hands of the price changes on the screen, the words and suggestions of whoever got him into the market in the first place or anyone else from whom he seeks opinions.”

Instead of a hypnotist swinging a watch before your eyes saying, “You’re getting sleepy; very, very sleepy,” the passing ticker symbols and market commentary chant, “you’re getting bullish; very, very bullish.”

Becoming part of the crowd is dangerous when prices go against the investor. “One of the most incomprehensible features of a crowd is the tenacity with which the members adhere to erroneous assumptions despite mounting evidence to challenge them,” write Moynihan and Paul.

The authors provide the illusion model that describes the process of investors becoming part of a crowd after a stock is purchased: Affirmation, Repetition, Prestige, and Contagion.

This is played out as investors express opinions about the market. Repeating those opinions further cements the idea in investors’ heads. If the market goes your way, you’re smart, you’re a hero. “Emotionalism overwhelms you (contagion). You’re hypnotized,” write Paul and Moynihan.

For losing trades, your ego keeps you in it. You’re courageous for sticking it out. “The market is wrong and will turn around. You take pride in your courage to go against the crowd because according to market lore, the crowd is supposed to be wrong.”

Paul and Moynihan tell us that we should have a plan when we invest or trade. And that requires thinking. They point out that only individuals can think. Crowds don’t think. “There is no such thing as a group brain,” they write.

Ms. Fox doesn’t sound like she’s part of any crowd I’m familiar with. At her tender young age, she takes what the market gives her. Sometimes from the long side, sometimes from the short side. “For me, long-term investing is just not my thing,” she says. The gains and losses are just numbers on a screen.

Ahh, to be 16 and fearless again.

No comments:

Post a Comment