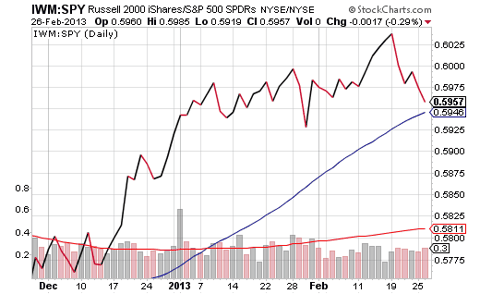

Chicago, Mar.4, hot stocks .- Over the last 3 months, U.S. small cap stocks as well as foreign and emerging market small caps logged spectacular profits. Moreover, they beat the pants off of larger-cap competition.

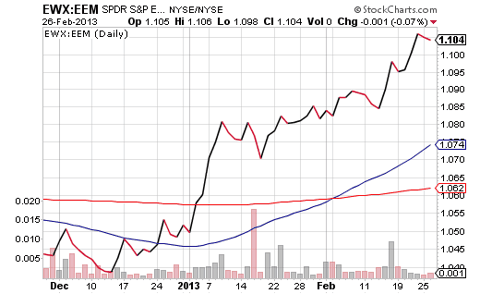

Consider the recent highs in various price ratios. For instance, SPDR S&P Emerging Market Small Cap (EWX):iShares MSCI Emerging Markets (EEM) demonstrates increasing relative strength for smaller emergers.

In brief, investors who embraced smaller companies over the last 3 months witnessed greater portfolio growth than those who did not. Yet there is evidence to suggest that the trend may not be sustainable.

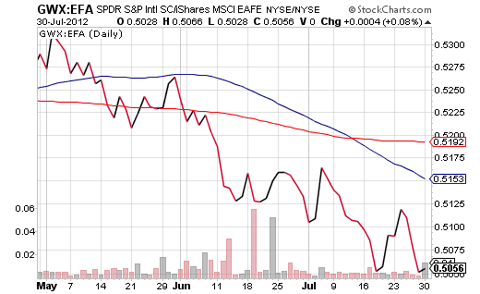

For example, in late April of 2012, Spain’s borrowing costs began to soar on speculation about the solvency of the country’s banks. The eurozone debt crisis degenerated over the next 10 weeks, until the President of the European Central Bank (ECB), Mario Draghi, assured the world that it would do everything and anything to protect the euro. During that harrowing period, market forces punished international small-caps in GWX far worse than they had larger companies in EFA.

Granted, there’s a difference between the Italian citizenry rejecting austerity than a fear-provoking run on European banks. That said,borrowing costs for Italy skyrocketed after the recent election produced a parliamentary government without sufficient alliances or votes to govern. It follows that any additional increases in the costs for Italy or Spain to borrow might lead to a similar rejection of riskier small-caps.

U.S. domestic small-caps are no less immune to eurozone troubles. While the S&P 500 SPDR Trust (SPY) shed 1.9% in Monday’s beating, iShares Russell 2000 (IWM) fell 2.2%. That 30 basis point difference may be typical for a broad-based shellacking. However, on Tuesday’s bounce (2/26), SPY climbed 0.7%, whereas IWM only rose 0.4%. Losing ground when markets move in either direction is somewhat ominous.

In my estimation, small caps are likely to underperform large caps over the next 3 months. Although the Federal Reserve may prevent any corrective activity from getting out of hand, anti-government protests in Europe coupled with a stalemate over automatic spending cuts in the United States would suggest a more defensive posture.

If you are only intrigued by minor tweaks, you might shift from small-cap dominated IWM to iShares Mid Cap Value (IJJ) or Vanguard Value (VTV). If you want to lower your volatility with a broader brush-stroke, PowerShares S&P 500 Low Volatility (SPLV) might serve as your replacement.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. ...

No comments:

Post a Comment