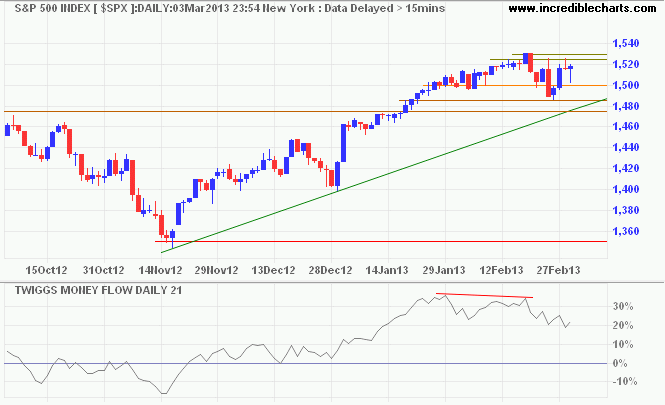

Sydney, Mar.4, daily stocks .- The S&P 500 is oscillating between 1485 and 1530. I avoided using the word “consolidating” because that implies a degree of calm. Far from it. Bearish divergence on 21-day Twiggs Money Flow continues to warn of medium-term selling pressure. Reversal below 1485 and the rising trendline would indicate a correction. Breakout above 1530 is less likely but would offer a target of 1575*.

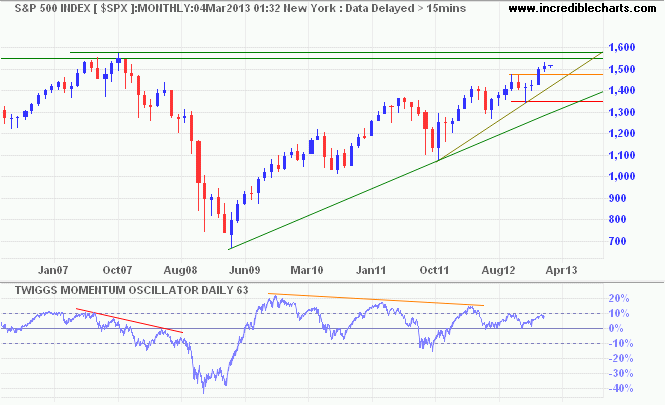

On the monthly chart we can see that a correction below the secondary trendline would target primary support and the primary trendline between 1350 and 1400. A 63-day Twiggs Momentum trough above zero would indicate continuation of the up-trend, while retreat below zero would suggest a primary reversal.

...

No comments:

Post a Comment