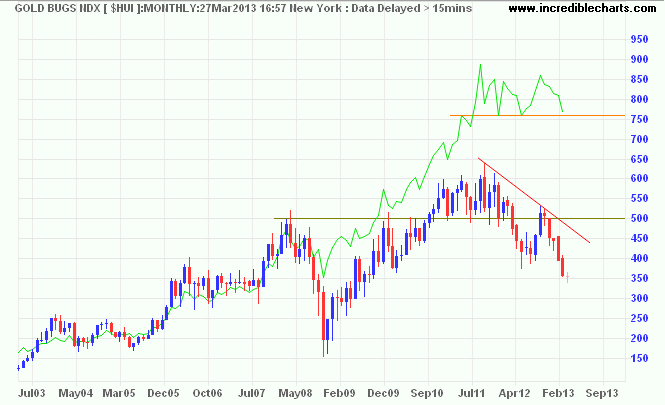

Sydney, Mar.28, stock watch .- The Gold Bugs Index ($HUI) representing un-hedged gold stocks has under-performed spot gold since the GFC in 2008, with a safe-haven premium priced into the metal. But $HUI diverged strongly in mid-2012, commencing a strong primary down-trend while spot gold continues to range above support.

I am not yet convinced that gold is headed for a primary down-trend, but substantial outflows from gold ETFs in recent months highlight investors returning to the stock market. Inflation is muted, with central bank expansionary policies merely counteracting deflationary pressures from credit contraction. Opportunities for another bull run on gold appear distant — unless a major catastrophe sparks more QE — but respect of primary support would signal further ranging between $1500 and $1800.

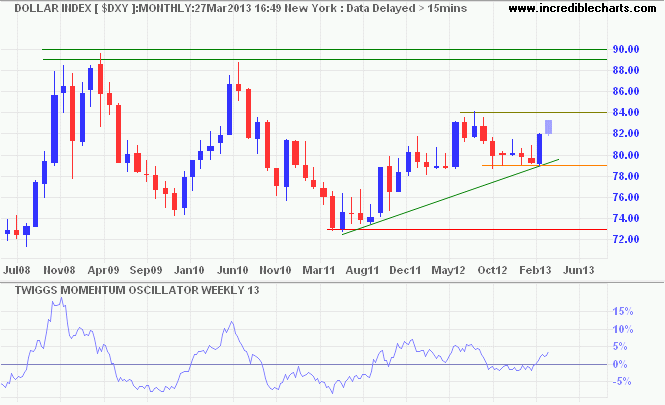

Dollar Index

A stronger dollar contributes to weaker gold prices. Breakout of the Dollar Index above 84.00 would signal an advance to 89.00/90.00. Rising momentum suggests continuation of the up-trend.

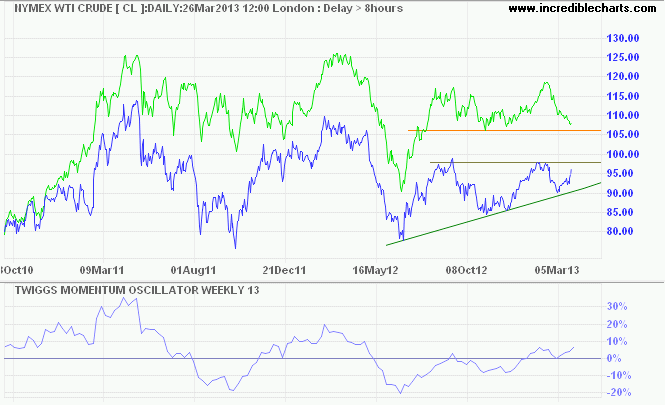

Crude Oil

Brent Crude is falling in response to the contraction in Europe, while Nymex Crude breakout above $98/barrel would signal a primary up-trend in response to a reviving US economy. Reversal of Brent Crude below $106/barrel would signal a primary down-trend, narrowing the price gap between the two continents.

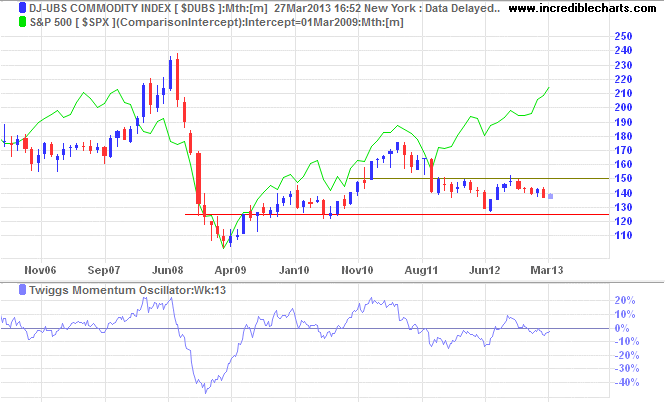

Commodities

Dow Jones-UBS Commodity Index is in a primary down-trend, headed for another test of the 2012 low at 126. Divergence between the index and S&P 500 suggests that the rise in equities does not reflect a recovery in the US manufacturing base — and may be prone to failure if manufacturing does not respond.

No comments:

Post a Comment