| English: NASDAQ in Times Square, New York City, USA. (Photo credit: Wikipedia) |

New York, Mar.27, hot stock picks .- I believe it is possible to discuss the situation in Cyprus until you collapse from exhaustion. Unfortunately, you'd get absolutely nowhere in the process...

But that's what most analysts are doing these days--which is why you're bombarded by an endless parade of unanswerable questions about the latest eurozone catastrophe.

What if banks stay closed and rallies turn into riots?

Is contagion a real possibility?

What if angry Russians show up?

At this point, it's all speculation.

You have to take the Cyprus developments in the context of the market's reaction as the events unfold. The market doesn't care what you (or I) think.

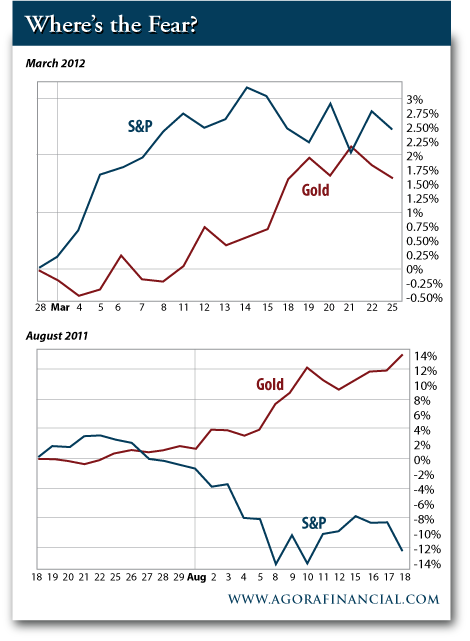

Fortunately, price gives you all the context you need. And you don't have to look back very far to see what a panicked reaction to a potential eurozone meltdown would look like. Less than two years ago, investors practically trampled each other to get to safety at the first sign of trouble in Europe.

But right now, the market has not flashed anything remotely close to a crash warning...

|

Today, we're not seeing the rush out of stocks and into gold that characterized the August 2011 correction. In fact, gold continues to trail the S&P this month even after its brief rally back toward $1,600. Even though the yellow metal is heading for its first monthly gain since September, Bloomberg reports that it will clock its first back-to-back quarterly loss since 2001. Ouch...

You can yell. You can throw your computer out the window. You can even send me an angry e-mail [Ed. Note: Why not? You'll feel better: rude@agorafinancial.com]. But at the end of the day, the market's the boss. Deal with it.

It's clear the collective mood is changing. Despite turmoil overseas, investors continue to favor U.S. equities. Will we eventually see weakness in stocks? Absolutely. Will these turn into buying opportunities? Yes.

U.S. equities are where you should be right now. That's not me talking--it's the market. ...

No comments:

Post a Comment