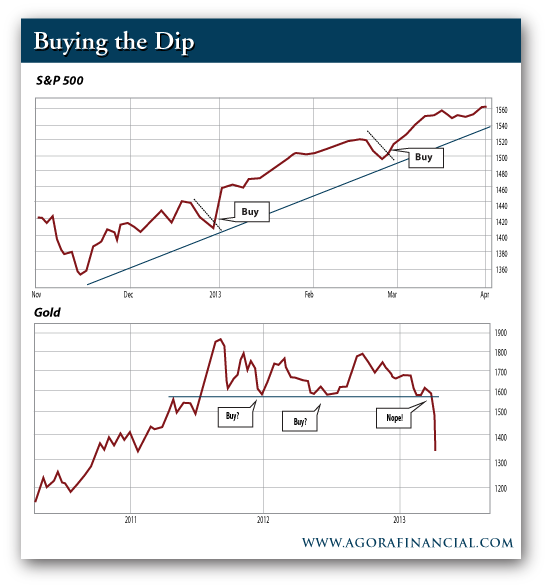

"When stocks go down, it's a buying opportunity and good to buy more. When gold goes down, to buy more would be foolish." You're oversimplifying the process... The reason I've advocated buying dips in stocks-- but not gold-- has nothing to do with the asset class. It's about the trends. The S&P has moved steadily higher for five months in a somewhat predictable fashion. That gives you the opportunity to buy into the rally when stocks bounce higher off support.

Gold is a different story. Just one glance at this gold chart shows that the uptrend's already cooked. Momentum is gone, so what you're left with is horizontal support. That changes the game. If you're buying for the long-term, you have to make some assumptions. You have to assume that a new uptrend will emerge after price bounces higher off support. That failed after a couple of attempts. And instead of another possible buy last week, the market told you to run like hell. You can put this information to good use in the markets right now. The S&P is flirting with uptrending support. How it reacts will determine the fate of the current equity rally. Here's my colleague Jonas Elmerraji with a complete breakdown: "The big price swings in the S&P have some equally big implications for traders right now. One of them is the idea that volatility is pouring back into the stock market after a long absence. A rebound in volatility shouldn't be hugely surprising – volatility is cyclical, after all, so a move higher in the VIX has been due. But remember that volatility can be in both directions (as we're seeing this week), so volatility added in the middle of a rally can actually help push stocks higher." How should you proceed? "And until the uptrend breaks in the S&P 500," Jonas concludes, "everything that happens is in the context of a rally." [Ed. Note: Jonas should be your go-to guy when it comes to booking repeatable trading gains. In fact, he just opened up a few seats in his free online trading experiment. Sign up while you can-- no market experience required.] |

|||

Our daily blog will give you the best stock tips, market trends and news alerts to stay on the top of your game.

Friday, April 19, 2013

How to "Buy the Dip" in One Chart

By Rude Awakening

.

Labels:

STOCK PICKS,

Stock tips,

stock trade

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment