| (Photo credit: blacksheepge1925) |

Sydney, May.2, free portfolios .- Recovery of the Dollar has been overrated. With restrictions on fiscal deficits, it will be difficult to contain deflationary pressures from the Great Credit Contraction which is likely to endure for at least a decade — following the Great Credit Bubble over the last 40 years. Fed quantitative easing is likely to endure for longer than many observers, myself included, initially expected. And inflation will remain low despite QE, which is offset by deflationary pressures from the Great Credit Contraction.

The lower inflation outlook is reflected by falling gold and rising bond prices.

The Great Credit Bubble

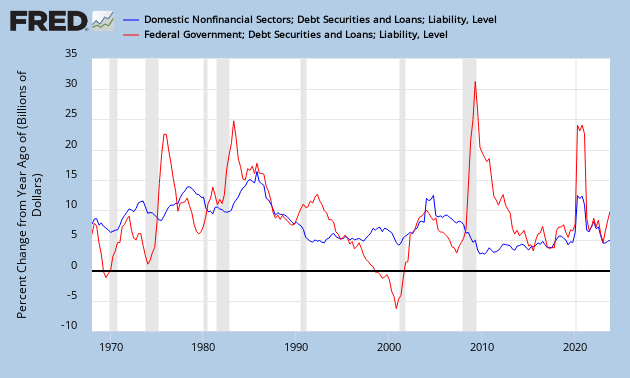

There were two distinct credit bubbles in the last 50 years: the first in the 1980s, the second in the early 2000s. The chart comparing growth in Domestic Nonfinancial Credit (both Private and Government) to nominal GDP shows two clear episodes where credit growth outstripped GDP. Both resulted in significant falls in GDP from which the economy struggled to recover. The latter episode fed into the housing market, leading to the global financial crisis.

The Great Credit Contraction

If we look at total Domestic Nonfinancial Credit, the rate of growth remained positive. So why call this a contraction? But the aggregate conceals a hidden danger: private household credit contracted, threatening a deflationary spiral similar to the 1930s — when GDP fell almost 50 percent.

Outlook for the Dollar

The Dollar has not benefited from the lower inflation outlook as interest rates are also likely to remain low. Primary advance of the Dollar Index ($DXY) seems to be losing steam, with a lower peak than mid-2012. Expect a test of primary support at 79. Penetration of the rising trendline would indicate trend weakness, while failure of support at 79 would signal a reversal. Twiggs Momentum is approaching the apex of a long-term triangle; reversal below zero and the rising trendline would also warn of a reversal.

No comments:

Post a Comment