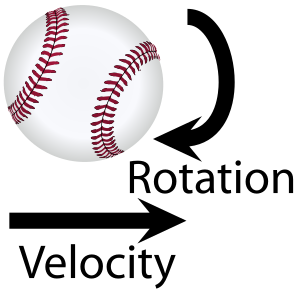

| English: Diagram on how to throw a curve ball. (Photo credit: Wikipedia) |

It would take one heckuva recovery rally for the weekly chart to repair itself

New York, Jun.25, stock advice .- Welcome to hump day, which given where the market currently sits may throw traders a curve ball or two. Since we never know what the outcome of any given trade will be, my mantra of dealing with this uncertainty is to fully embrace it. If we fully embrace the inherent uncertainty in trading, then sticking to our rules becomes easier.

On Tuesday morning, more than a few readers asked me how significant I suspect that May 22 top in equities was. Given the strong signals from other asset classes, as well as the points I’ll make in a moment, I imagine it’s entirely possible that the S&P 500 has seen its high for the year, or at the very least until the November-to-December period.As I discussed in yesterday’s Daily Market Outlook, the May 22 top in the S&P 500 was only a matter of time given the loud signals that both the commodity and bond markets had flashed since 2012.

1. While the November trendline break that occurred last week looks nasty on the daily chart, it is even more pronounced on the weekly chart below. As a general rule of thumb, the longer a chart’s time frame, the more value I give to a signal. At this stage, for the weekly chart to repair itself it would take one heckuva recovery rally.

2. Looking at the yield of the 10-year U.S. Treasury note, the sheer magnitude of the rally over the past month or so is enough to scare some bulls out of the market at least for the time being, even though from a macro perspective a rising yield environment is bullish for equities in the early to mid-part of a recovery. The question, of course, is whether after a four-and-a-half year bull market we can still classify this as early/mid, or as a recovery at all.

Confused? You should be, which is exactly why I chose to be a trader rather than an economist.

Heading into last week the S&P 500′s daily chart was once again quite arrogantly waving a so-called bull flag formation, which on Thursday, quickly broke to the downside. As the saying goes, “from false moves come fast moves.” The broken bull flag pattern on the daily chart is the first meaningful bullish pattern I saw failing thus far in 2013.

In the immediate term, with Monday’s bounce off the 1,560 area and Tuesday’s continuation buying, the S&P 500 has recovered the most overbought readings to some extent. I for one am looking to nibble at the short side of this market again around the 1,590 to 1,600 area. ...

No comments:

Post a Comment