Washington, Jun.25, free portfolios .- Most investors believe gold is highly correlated with inflation.

And to an extent, it is...

As the dollar loses value, anything priced in dollars will appreciate.

But as Oxford Club Investment Director Alexander Green stated when gold was near its all-time highs:

"Gold is a wonderful inflation hedge. But the metal is up more than fivefold over the last 12 years and inflation is still not a problem. Is it not conceivable that inflation could tick up and gold - having already discounted this - moves lower?"

One connection most investors miss, however, is gold's stunning correlation with something that's being completely manipulated by the Fed right now - interest rates.

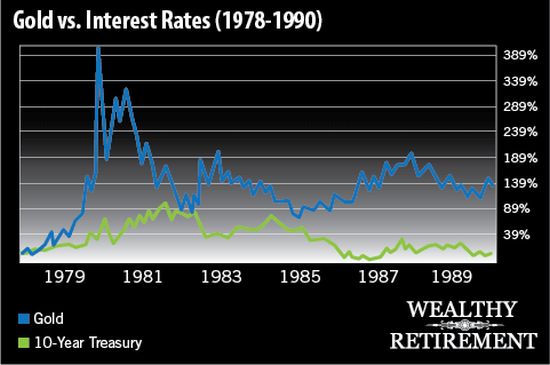

Just take a look below at what happened to gold during the high inflation of the early 1980s:

The fact is, interest rates have a much more profound effect on gold prices than you've been led to believe. As you can see in the chart, there's an almost perfect inverse relationship between the two.

There could be plenty of reasons for this...

For one, it could be that conservative investors looking for safety in a low-rate environment flock to gold. Then, when savings accounts and other "safe" investments such as Treasurys resume paying respectable yields, these investors return to these instruments - since gold doesn't pay dividends.

Of course, that's all speculation on my part.

The important thing you need to know is that when rates rise, the price of gold usually goes down...

And we all know rates, which have been held artificially low by the Fed to spur liquidity, are headed in just one direction.

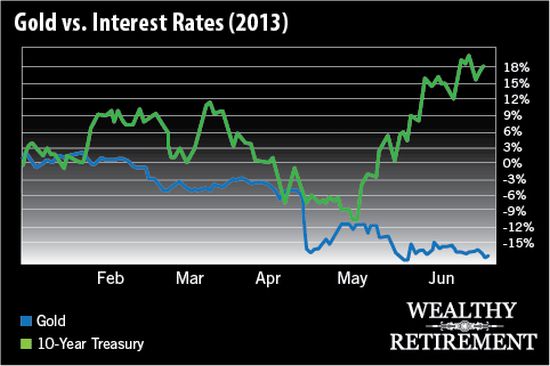

As Bernanke and the Fed begin winding down their bold $85 billion/month bond buying program, rates should continue to rise while gold and bond prices continue their downward spiral.

Warren Buffett recently put it like this:

"You've got some guy buying $85 billion [worth of bonds] a month. And that will change at some point, and when that changes people could lose a lot of money..."

Just take a look at what's happened so far this year...

What nobody knows with any real certainty is the exact schedule of the Fed's coming "taper."

So far most of the market moves have been completely based on speculation.

On Wednesday, in his post-FOMC news conference, Bernanke said that it's possible we'll see the taper begin later this year and completely end by the middle of 2014. But - and this is a big but - things have to go right.

The Fed had previously told us it wasn't planning to do anything until unemployment in the United States hit 6.5% and inflation reached 2%. The original projections for these were sometime in 2014-2015.

Since then, Bernanke has changed his tune slightly and on Wednesday said that the new unemployment target is 7%. He mentioned that if unemployment hits 7% by mid-2014, the Fed will stop buying bonds.

But for now, nothing has really changed.

The Fed is still suppressing short-term rates, and it's still buying just as many bonds as it has been for the past seven months.

So the most recent spike in rates is obviously the result of speculation. And it's possible there's been an overreaction in the short term. But ultimately, this speculation is well-founded. These rates are undoubtedly going to push higher in the long term - they have to.

And, using history as our guide, that doesn't bode well for gold right now.

P.S. Marc Lichtenfeld has seen this interest rate situation building up for more than 18 months now. He's used that time to devise the absolute best way for himself and his readers to handle rising rates and a crashing bond market. His findings may surprise you...

Rather than trying to time the market by shorting bonds, he's found a little-known type of income investment that safely leverages the power of the Fed. These "Spread Trusts," as he calls them, spew out as much as 19% annual yields. Better yet, they're set to shoot up as much as 164% when the bond market finally reaches its tipping point.

To see all of his work on what's going to happen and how you can prepare yourself, click here.

.

No comments:

Post a Comment