| Image via CrunchBase |

Boston, Jul.30, stock investing .- Every Wednesday, I write The Safety Net column, where I examine the dividend safety of a stock that is suggested by readers.

The importance of dividend safety might be obvious to some, but there are investors who yawn at the mention of a dividend. For them, combine the word "safety" with "dividend" and it's a one-way ticket to Snoozeville, which I hear is lovely this time of year.

But the importance of dividend safety isn't just a matter of collecting $40 in dividends versus $20 if the dividend is reduced. A dividend cut can be disaster for the stock price too.

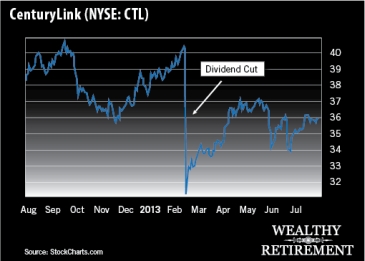

Last week, in my discussion of Windstream (Nasdaq: WIN), I mentioned the poor performance of CenturyLink (NYSE: CTL) after it cut its quarterly dividend to $0.5425 from $0.725. The stock tanked 23% on the news.

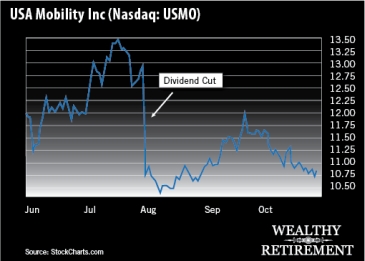

In August of last year, USA Mobility (Nasdaq: USMO) slashed its dividend in half, cutting the quarterly payout to $0.125 from $0.25. The result was an 18% plunge in the stock. It has since recovered, but shareholders had to wait eight months to be made whole again - although they're now receiving a much smaller yield.

There can be lots of reasons a company will cut its dividend. Usually, it's because it has to. It simply isn't making enough money to pay shareholders and meet its other obligations like paying interest on debt, or keeping the lights on and the driver for the CEO.

Sometimes management wants to hang on to the cash in order to fund growth plans such as expansion or an acquisition. Other times it prefers to use the money to buy back stock. I always prefer the dividend. Academic studies have shown that stocks perform better when a strong dividend is paid versus a stock repurchase plan.

Looking for Clues in Cash Flow

I spend a lot of time in my Safety Net columns explaining how I determine the safety of a dividend.

It's all about the cash flow. (I'm not so concerned with earnings because earnings are easily manipulated and include all kinds of non-cash expenses, such as depreciation, that artificially lower the profit.)

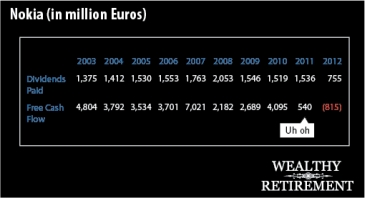

As an example, let's take a look at Nokia (NYSE: NOK).

Last year, the company cut its dividend in half. This year, it failed to pay a dividend for the first time since 1871. That's not a typo. Nokia paid a dividend to shareholders every year starting six years after the American Civil War. This year, it did not.

When we look at the last 10 years' worth of free cash flow, we see that Nokia was generating billions of dollars in free cash flow until 2010, when it slipped to only €540 million. I say "only" €540 million because it was paying out over €1.5 billion in dividends. In 2011 and 2012, free cash flow swung to a negative number. That means that it cost the company money to run its business.

That's not sustainable for paying a dividend.

So management did the financially responsible thing: It cut and then abolished the dividend.

The stock was punished, falling from over $11 in 2011 to a low of $1.63 late last year. It rebounded to $4 but is still well below where it traded before the dividend cuts.

But investors had a warning in 2011 when free cash flow fell dramatically. And by 2012, they should have known the dividend was in jeopardy as free cash flow numbers turned negative.

It's important to understand the safety of your stocks' dividend if you don't want to wake up to a 15% or more haircut in the stock price. That's the kind of excitement no one wants.

...

No comments:

Post a Comment