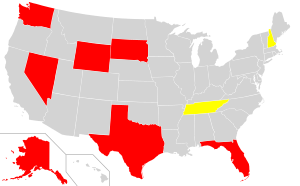

| English: Map of USA showing states with no state income tax in red, and states that tax only interest and dividend income in yellow. No state income tax Tax only on interest and dividend income (Photo credit: Wikipedia) |

Boston, Jul.15, free stock tips .- Dividend growth stocks are the gift the keeps on giving. If you have had the fortitude to identify, analyze and purchase a portfolio of at least 30 individual income stocks, you should be able to enjoy a rising stream of dividend income over time. Whether you reinvest your distributions or decide to spend them, you will be able to generate dividends for many years, from a simple idea that occurred to you several decades prior. In order to achieve maximum results however, you need to purchase shares at attractive entry price, then diversify and reinvest dividends in the best values, rather than automatically.

Over the past week, several dividend growth companies announced their intention to boost distributions to their shareholders:

Walgreen Co. (WAG), together with its subsidiaries, operates a network of drugstores in the United States. The company increased its quarterly dividend by 14.50% to 31.50 cents/share. This marked the 38th consecutive dividend increase for this dividend champion. Over the past decade, Walgreen has managed to boost distributions by 21.20%/year. Currently, the stock is trading at 21.33 times earnings and yields 2.60%. I would consider adding to my position on dips below 20 times earnings. Check my analysis of Walgreen.

Enterprise Products Partners L.P. (EPD) provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, refined products, and petrochemicals in the United States and internationally. The partnership increased its quarterly distribution to 68 cents/unit. This marked the 16th consecutive dividend increase for this dividend achiever. Over the past decade, Enterprise Products Partners has managed to boost distributions by 6.70%/year. Currently, the partnership yields 4.20%. I recently sold 2/3 of my position in the partnership, because I found it to be overvalued. Check my analysis of Enterprise Products Partners.

ConocoPhillips (COP) explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas, and natural gas liquids on a worldwide basis. The company increased its quarterly dividend by 4.50% to 69 cents/share. This marked the 12th consecutive dividend increase for this dividend achiever. Over the past decade, ConocoPhillips has managed to boost distributions by 15.10%/year. Currently, the stock is trading at 10.50 times earnings and yields 4.20%. This is one of the few types of stocks that are undervalued in today’s market. Check my analysis of ConocoPhillips.

Genesis Energy, L.P. (GEL) operates in the midstream segment of the oil and gas industry in the Gulf Coast region of the United States. Thismaster limited partnership increased its quarterly dividend to 51 cents/unit. This marked the 10th consecutive dividend increase for this dividend achiever. Over the past decade, Genesis Energy has managed to boost distributions by 8.60%/year. Currently, the partnership yields 3.80%. I largely believe that investors who get a current yield of less than 4% today from pass-through entities such as Genesis Energy or Plains All American Pipeline are generally way too optimistic, despite low current interest rates. Their funds might be better invested elsewhere.

Plains All American Pipeline, L.P. (PAA), through its subsidiaries, engages in the transportation, storage, terminalling, and marketing of crude oil and refined products in the United States and Canada. The partnership increased its quarterly distributions to 58.75 cents/unit. This marked the 13th consecutive dividend increase for this dividend achiever. Over the past decade, Plains All American Pipeline has managed to boost distributions by 7.20%/year. Currently, the partnership yields 4.30%.

Cummins Inc. (CMI) designs, manufactures, distributes, and services diesel and natural gas engines, and engine-related component products. The company increased its quarterly dividend by 25% to 62.50 cents/share. This marked the 8 consecutive dividend increase for the company. Over the past decade, Cummins has managed to boost distributions by 19.60%/year. Currently, the stock is trading at 14.80 times earnings and yields 2.20%. The company looks interesting, and I would put it on my list for future analyses. ...

No comments:

Post a Comment