| Dow Jones 2006 (Photo credit: caseorganic) |

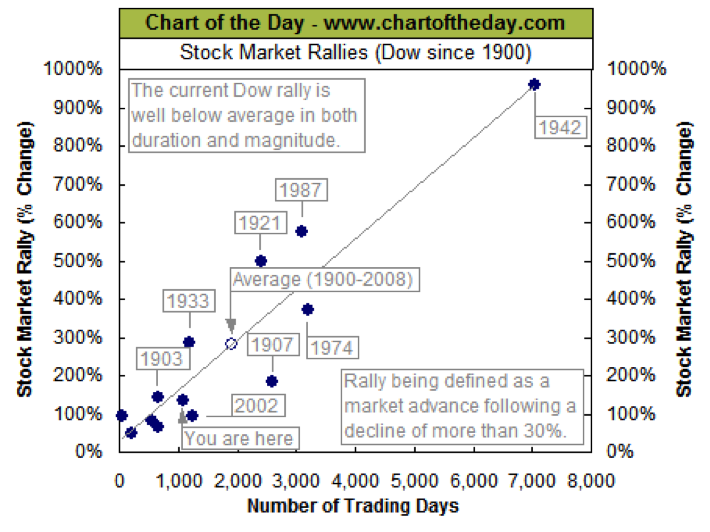

Baltimore, Jul.19, hot stocks .- More new closing highs courtesy of the Dow Jones Industrial Average have unnerved many investors this week… again. The worries stem from the scars of the financial crisis. For the past decade, new highs (or approaching new highs) signal that it's time to get the hell out. Sure, it's easy to remember the recent pain. But if you take a couple steps back, you'll find that new highs aren't so ominous after all. What about when the Dow was making highs in 1983? What about 1992? Or 1995? Each of these appearances of new highs was a strong buy signal. I could go on, but I think you get the point. Another popular complaint that usually travels with the "new highs are bearish" theme is that the market is overextended. The Dow has chugged higher for more than four years, so another crash is in order. But is today's market overextended compared to other post-crash bulls? Chart of the Day has my back on this one…  This chart shows all major market rallies of the last 112 (a rally in this case is an advance that follows a 30% decline). You'll find the current rally in the bottom left corner. As the chart shows, the current Dow rally has been shorter and less powerful than most post-crash rallies over the past century. "The Dow has begun a major rally 13 times over the past 112 years which equates to an average of one rally every 8.6 years," Chart of the Day explains. "As it stands right now, the current Dow rally that began in March 2009 (blue dot labeled you are here) would be classified as well below average in both duration and magnitude." Don't allow new highs to scare you away from this market. More gains are on the way in the coming months… |

| ... |

No comments:

Post a Comment