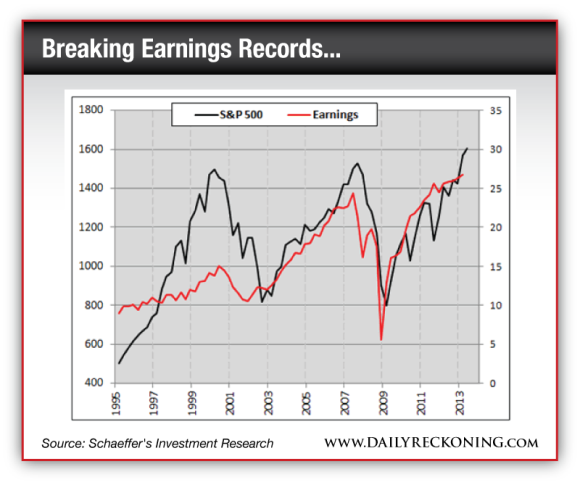

Baltimore, Ago.1, trading stocks .- One of the top complaints I'm seeing these days goes something like this: The stock market has gotten ahead of itself. Stocks are trading way higher than they should relative to the slow pace of the economic recovery. The fundamentals just can't support these prices at new highs… Well, it's earnings season. So let's tackle this concern head-on, shall we?  "For the fourth quarter of 2008, total earnings for S&P 500 index components were just $5.62. Compare that with the record $26.74 that was earned in the first quarter of this year, and you have more than a 375% jump," explains Schaeffer's Ryan Detrick. "Now sure, that is why we use yearly trends to look at this, as short-term data can get very choppy. Still, I think this helps put things in perspective. The market is up a lot, but maybe it is justified." Maybe it is. This perspective is important to keep in mind. And while it would be ideal to see some actual revenue growth sometime soon, it's clear that the broad market isn't as far ahead of itself as your bear market bias would lead you to believe. I'm seeing some strong numbers hitting the wire this morning. Employment and GDP were both solid beats. Now the market waits on Bernanke. Stay long through the consolidation. This market isn't the runaway train you're making it out to be… |

Our daily blog will give you the best stock tips, market trends and news alerts to stay on the top of your game.

Thursday, August 1, 2013

Don’t Get Ahead of Yourself…

By The Rude Awakening

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment