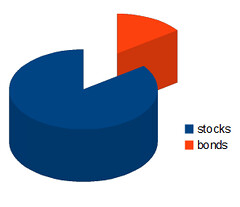

| Difference Between Stocks and Bonds (Photo credit: Philip Taylor PT) |

New York, Aug.13, investment opportunities .- Despite the five-year run-up in the market there is a way to get great bargains by playing the beaten-up industries – i.e. bottom-fishing. And there is a technique that can allow you to do it without the usual risks associated with trying to catch falling knives…

Today I'm going to share a great example of how to use the technique to earn a reliable double-digit yield, but first let me explain why most bottom-fishing strategies fall short…

Knowing when a bargain will stop becoming an even better bargain is almost impossible to predict. Wall Street's paved with the blood of those who thought they could – and learned the hard way they could not.

That's why the only investors who typically venture into bottom-fishing for cheap stocks are:

- Novices who don't know any better, or…

- The very experienced who periodically get a little too full of themselves and forget the costly lessons the market has taught them.

And, this strategy eliminates almost all the high-risk aspects of bargain hunting. It can be a big income producer and generate great capital gains, as well.

Three Reasons Cheap Bonds Are Better

Despite what most people think, bonds – all bonds – fluctuate in value. In fact, if an industry is getting hit particularly hard, corporate bonds, on a percentage basis, can drop in value almost as much as some stocks.

But there are several differences that make cheap bonds a much safer and more predictable way to play the bottom…

The first is the fact that no matter how low a bond's price drops, or how much it drops after you buy it, it continues to pay its interest. The coupon, which is cast in stone when the bond is issued, is cranked out every six months no matter what happens to the market price of the bond.

For instance, a 7% coupon will pay $70 a year in two equal payments, until maturity, whether the price goes up or down. And, unlike dividend stocks, the interest is paid to the bondholder from the time he takes possession.

So, the first big hurdle in bargain hunting is avoided; with bonds you make money all the way to maturity, from day one, no matter what the price does.

The next big difference between stock and bond bottom-fishing is no matter what you pay for a bond, at maturity, you get $1,000 for it. And yes, this is cast in stone, too.

Imagine being able to buy a stock at a 15% or 25% discount and know that in a set amount of time you will be paid the preset price of $1,000 for it. It seems almost too good to be true, but that is exactly what bonds offer.

The third big advantage of cheap bonds is that you know, before you invest one penny, exactly when and how much you will earn in interest and capital gains. There is no guesswork!

The interest and principal are paid on preset dates and, short of a default, which in this market is less than a 2% risk, nothing will change that.

AK Steel: A Beaten-Down Bargain

Here's a bond in a very beaten-up industry, steel, that will pay a big capital gain at maturity, a huge interest rate for this market, and you will know before you invest one dime how much your total return will be and exactly when you will receive every penny.

AK Steel has a bond (CUSIP - 001546AL4) with a coupon of 7.625% that we can buy now for about 86.2, or $862 per bond. At maturity in May 2020 we will receive $1,000 per bond in principal, $138 in capital gains, and will have collected 15 interest payments for a total of $571 per bond. That's a total return of $709 per bond, plus your principal.

On an income basis, $571 in interest equals a current yield of 8.84% per year. Current yield is based on our discounted purchase price of $862. It is calculated by dividing the coupon, 7.625%, by our cost, $862; 7.625 \ 862 = 8.84%.

Here's how the total return breaks down…

We have 15 interest payments of $38.12 every May and November until maturity, capital gains of $138 per bond at maturity, for a holding period of just under seven years, at a cost of $862 per bond, for an average annual return of 11.91%:

(15 x 38.12 + 132 / 82 / 862 x 12 = 11.91%)

The steel industry has been hit hard by the slowdown in China. The EU hasn't helped and the United States' own slow recovery has added to the drag, but the future looks very bright for AKS.

It's expected to move from a loss in 2013 of $0.50 per share to a profit of $0.31. That is a huge move in just one year!

Maybe more impressive are its five-year growth numbers. The industry is expected to grow at about 3.91%... But in the same period, AKS is looking at a 53% growth factor.

But, one of the best parts about bottom-fishing for bonds is, even if AKS doesn't hit these high numbers, even if it misses by a little – or a lot – it doesn't matter.

Unlike stocks, bonds are not dependent on the whims or the changing winds on Wall Street, or even quarter-to-quarter swings based on earnings.

As long as AKS is able to pay its bills when this bond matures (which with a 53% five-year growth estimate seems like a slam dunk), we will be paid every dime of our interest and capital gains. Even if stock and bond prices continue to drop, we still get paid.

That's how you bottom-fish. With cheap bonds you can…

- Make money from day one.

- Exceed the long-term return of the stock market by almost four points.

- Know when and how much you will earn before you invest.

Take a look at cheap bonds.

...

No comments:

Post a Comment