| Fed Up (Photo credit: Wikipedia) |

Instead, the Fed reminded everyone that they care about prices, not just employment. They care that their favored measure for inflation is staring down the barrel of deflation -- still, after three rounds of QE (the believed antidote to deflation).

As I've said, the Fed is telling us what they are doing, we just have to listen. In June, Bernanke laid out a plan for how they would scale down QE. It included two things: Unemployment improving dramatically and prices on a path toward its 2% inflation target. So far, we have a higher print in unemployment, and the second lowest reading on record for the Fed's inflation gauge. So, while many have been expecting the Fed to scale back QE at their next meeting in September, the data is telling us it's not going to happen.

Bottom line: If their thresholds are not met, more QE. If they are met, that's great, because it means the economy is doing much better.

This is a win-win for stocks.

First, as Bernanke has said explicitly, QE tends to make stocks go up. This Fed action serves as a defense against shock risk. And shock risks are what has kept people wary of stocks.

Second, a dramatic improvement in the economy, in the current climate, would make U.S. stocks the favored investment in the world.

It's also a win-win for the dollar.

Given the rest of the world is in recession, spiraling into recession and/or unleashing unprecedented monetary easing, U.S. assets remain the best alternative, even with the Fed in full QE mode. On the other hand, given that back drop, if the U.S. economy does do dramatically better, yields tick up, companies produce better earnings, real estate values rise -- all of which make U.S. assets extremely attractive on a relative basis. That's all very good for the dollar.

BOE and ECB: A Big Deal

So, with the Fed behind us, we have two central bank meetings tomorrow, which I would argue, are more important than the Fed right now.

The Bank of England will likely do nothing tomorrow, but they have already told us that on August 7th, they are looking to get the greenlight from the UK Treasury to ramp up their QE (i.e. they need to Treasury to sign-off despite the fact that inflation is running hotter than their target of 2%). I suspect this is where the next big catalyst for markets will come. We thought that Carney would come in and adopt a Fed-like aggressive easing assault, and so far that is what looks like is coming.

With that, we may get an inter-meeting surprise from the BOE in August to put the full-court press on the feeble growth problem.

But first, we get the ECB tomorrow. And it's a big deal. While the Fed has dominated the discussion, the ECB actually made a bold move last month, which went relatively un-noticed. They too, took to the Fed's playbook, and gave "forward guidance." This, as the Fed describes it, is a monetary policy tool. In this case, it's an easing tool. And it was so ignored, Draghi actually had to stop and inform everyone in his July press conference that they actually made a policy change. Could that foreshadow another move tomorrow -- perhaps?

Given the above, fundamental backdrop, we have two charts that set-up to harshly pinch the vulnerable.

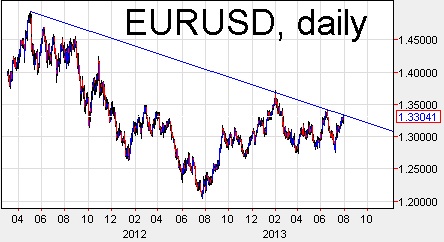

First, here's a look at the EURUSD.

Despite the technical breakdowns across currencies (aud, nzd, gbp) the EURUSD has continued to climb into this huge trendline dating back to May 2011. With the increased probability of more ECB easing, the euro sets-up for another down-leg here -- to sell against this line. The euro has the most aggressive trimming of short positions across currencies over the past year. And that creates vulnerability.

If we do get a slide in the EURUSD into the end of the week, we have a potential bearish outside week in development (a key reversal signal). It would require a move below 1.3132 and a close on the week under 1.3200. The last three bearish outside weeks have predicted declines of 400 pts, 700 pts and 400 pts, respectively.

Next, stocks ...

The S&P 500 printed 1700 on July 1. A month later we sit just 10 points off of that all-time high. Everyone that has feared the Fed taper, has hedged, has shorted the S&P, has thought collapse was coming; now sits, after today's Fed event (the event that have been waiting for), staring at the all-time high.

Markets tend to find vulnerability. And the vulnerability in stocks is clearly to the upside. Expect a massive fireworks show on the break of 1700, as all of the shorts get squeeze, the hedgers cover, and the fund managers that have been sitting on cash, hoping and wishing for a pull-back, get forced to close their eyes on buy stocks. This 1700 mark is the line of demarcation -- where the worriers stop worrying, and become the next brain trust you see on TV, trying to reinvent themselves, telling us how great the stock market is.

...

No comments:

Post a Comment