| English: Target sponsored IndyCar visiting Purdue University on Toyota Day. (Photo credit: Wikipedia) |

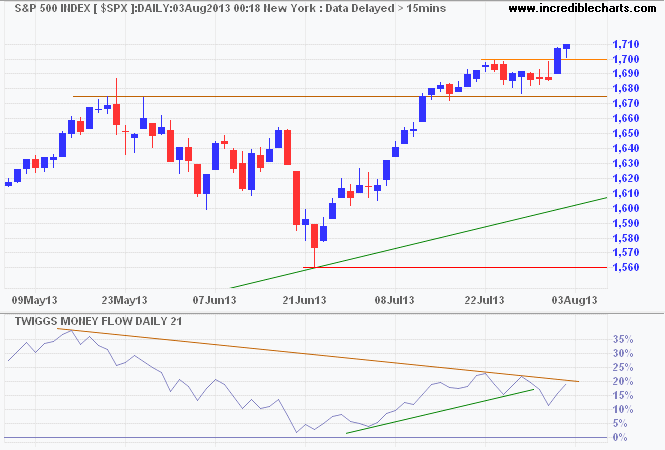

Sydney, Aug.5, investment opportunities .- The S&P 500 followed through above resistance at 1700, indicating an advance to 1800*. Bearish divergence on 21-day Twiggs Money Flow suggests selling pressure, but this is not as pronounced on the weekly chart and a peak above the May high would negate this. Reversal below support at 1675 remains unlikely, but would warn of another test of primary support at 1560.

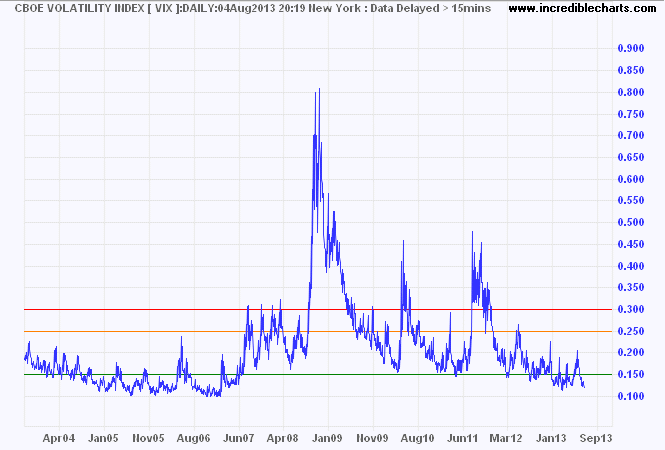

The VIX below 15 indicates historically low market risk.

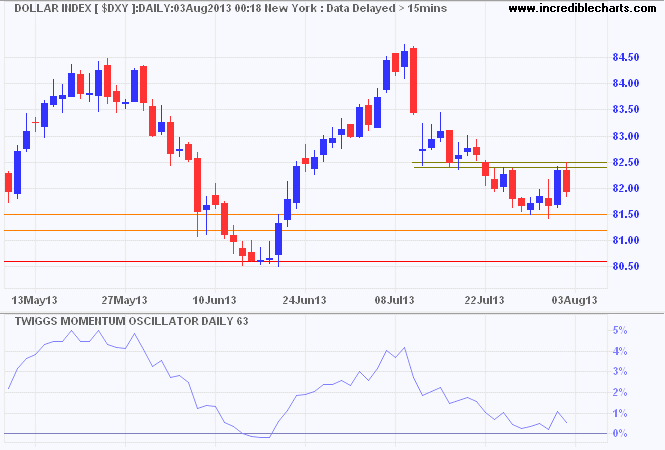

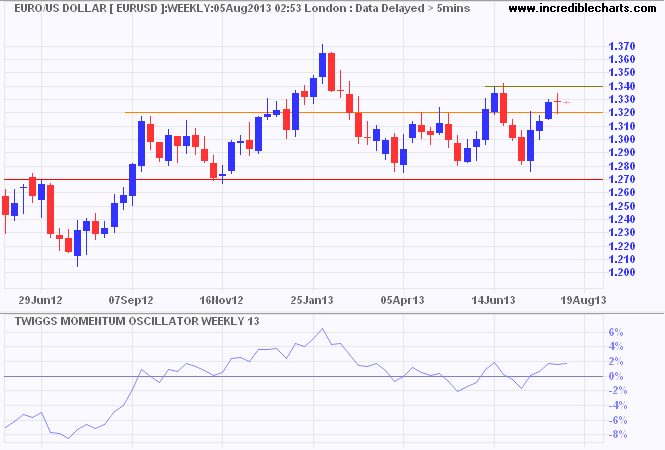

The Euro broke medium-term resistance at $1.32 and is testing the next level at $1.34. Breakout would indicate a primary advance, while respect of resistance (indicated by reversal below $1.32) would warn of another test of primary support at $1.27. Close oscillation of 13-week Twiggs Momentum around the zero line reflects hesitancy.

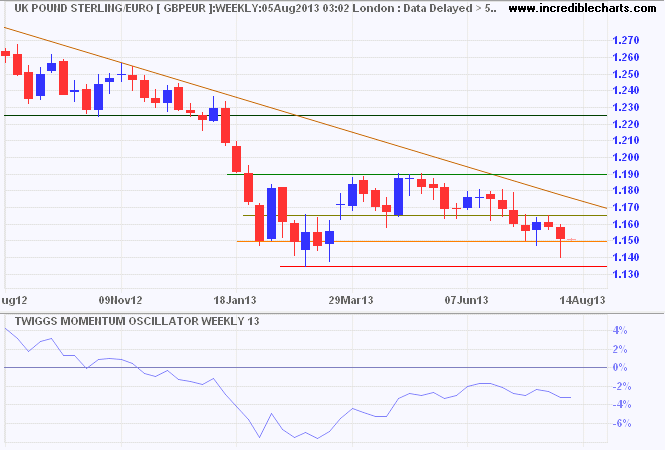

Sterling is testing primary support at €1.135 against the euro. Long tails indicate buying pressure and recovery above €1.165 would suggest that a bottom is forming. Breakout above €1.19 would complete a double bottom with a target of €1.24. Recovery of 13-week Twiggs Momentum above zero would strengthen the signal.

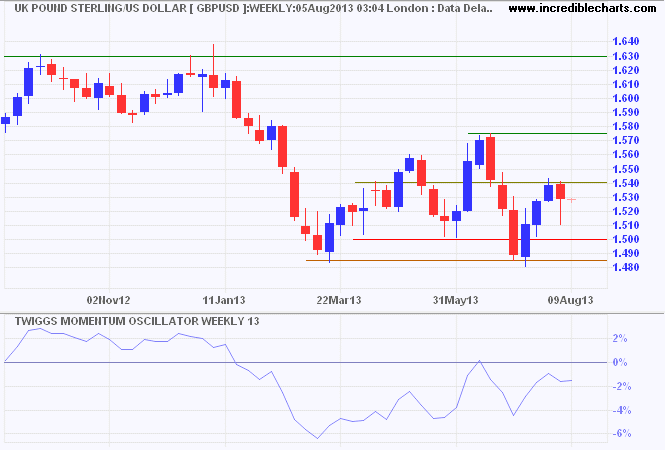

Against the greenback, Sterling is testing medium-term resistance at $1.54. Last week's long tail suggests buying pressure. Breakout would offer a target of $1.575. Respect is less likely, but would indicate another test of primary support at $1.485. Recovery of 13-week Twiggs Momentum above zero would strengthen the bull signal.

...

...

No comments:

Post a Comment