| omega (Photo credit: davedehetre) |

Palo Alto, Aug.8, stocks to watch .- In October 2011, I recommended Omega Healthcare Investors Inc (NYSE: OHI) in my former newsletter, The Ultimate Income Letter. The stock remains in The Oxford Club’s Perpetual Income Portfolio (which I am no longer personally tracking). Since it was first recommended, it has returned 86%. During the same period, the S&P 500 has returned 40%.

For the past few weeks, several readers of The Safety Net have requested I take a look at the dividend safety of Omega Healthcare, which operates as a landlord for nursing homes and long-term care facilities.

At the time, the sector was very beaten down due to worries about cuts to Medicare. That enabled us to snag an investment with an 8.9% dividend yield. Because the stock has appreciated so much, it currently offers a yield of 6.2%. But investors who got in on the original recommendation are enjoying a yield of 10.6% now that the dividend has increased from $0.40 per share in late 2011 to $0.47 now. A 17.5% increase in less than two years. That’s why I’m such an advocate of the dividend growth strategy. Most people would be thrilled with a 17.5% raise in less than two years. That doesn’t happen too often in the working world. But in the right dividend stocks, it can happen all the time.

But I digress. Back to whether Omega’s dividend is still safe.

As a real estate investment trust (REIT), Omega Healthcare must pay 90% of its earnings back to shareholders in the form of dividends. As a result, the company, and other REITs, do not pay corporate income tax on those earnings.

But anyone who has read my columns for even just a little while knows that I consider earnings to be just the beginning part of the cash flow equation. I don’t worry about earnings. I look at cash flow because cash flow tells the real story as to the health of the business.

A company could have great earnings, but if it has no cash left over at the end of the quarter or year to reinvest back into the business or pay shareholders their dividends, that’s a problem.

So let’s take a look at Omega’s numbers to determine if the dividend is indeed safe.

For the first half of 2013, Omega earned $0.76 per share but paid out $0.91 per share. Someone who looked at the company’s payout ratio would see an alarming 120%, meaning the company is paying out 120% of its earnings in the form of dividends.

That would scare off most investors because that is typically not sustainable. But this is a perfect example of why I don’t worry about earnings when it comes to dividend safety.

REITs often report cash flow as funds from operations, or FFO. For the first six months of the year, Omega’s FFO was $1.25 per share. That’s a big difference from $0.76 per share, especially when comparing it to $0.91 per share in dividends paid.

The reason for the big difference is non-cash items. When calculating net income, Omega expensed over $64 million in depreciation and amortization. Those are non-cash expenses. In other words, Omega did not actually pay out $64 million in cash for those expenses in the first half of the year. Yet those non-cash expenses lower net income.

Because a non-cash expense does not reflect the actual movement of cash, it is added back into cash flow calculations. A few other smaller adjustments and the company reported FFO of $144.5 million instead of $87 million in net income. That’s a big difference.

Now instead of a 120% payout ratio when using earnings as the basis, we have a payout ratio of 73% when using FFO. Also a big and meaningful difference.

Typically, I like to see a payout ratio of 75% or lower. That gives me the confidence that even if the company hits a rough patch, it will be able to continue to increase the dividend in the near future.

Omega Healthcare Investors has raised the dividend for 11 consecutive years. Last year, it raised the dividend twice during the year.

If Omega was able to increase the dividend even during very difficult periods of Medicare cuts and uncertainty, considering it has plenty of cash flow, I see no reason why it won’t be able to continue to raise the dividend for the foreseeable future.

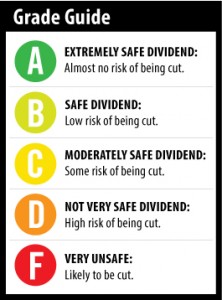

Dividend Safety Rating: A

...

No comments:

Post a Comment