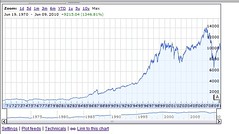

| This is the Dow Jones Industrial Average over the last 40 years. (Photo credit: The_Smiths) |

The Dow industrials have turned away from the high of 15,710 made only four sessions ago, and have penetrated into the broad support zone of 14,760 to 15,400. Within that zone is its next meaningful support, the 50-day moving average at 15,310.

The blue chips held for most of the day, but in roughly the final hour and a half of trading, the Dow plunged over 100 points, led by the financials. The bias is against the blue chips and in favor of small-cap and mid-cap stocks.

The Nasdaq’s bull channel is much like the Russell 2000′s channel illustrated on Monday. Trading is clustered close to the top of its range, and so, with MACD overbought, the Nasdaq could pull back to its 50-day moving average at 3,657.

Conclusion: If you must own stocks or are a trader, grabbing the small-cap and mid-cap technology stocks appears to be the best near-term strategy since that is where the buying is concentrated and momentum is strongest.

Even the broad-based S&P 500 closed below 1,705, a near-term inflection point. Its next support is its 50-day moving average at 1,679. But volume was high on last week’s advance and has declined on the blue chips’ pullback. The bright side of the blue chips’ near-term weakness is that some big, profitable names can be bought at reasonable prices like my Top 6 Stocks to Buy for October...

No comments:

Post a Comment