After a recent article titled the Best Dividend ETF in 2012? (You'll Never Guess), I received requests to write a piece that focused on the domestic dividend ETF universe. Domestic ETFs didn't rank in the previous article as global dividend ETFs have captured the leading performance spots in 2012. The funny thing is, the largest dividend ETFs and the most amount of dividend ETF assets are in the domestic space. So here's the run down on the 12 domestic ETF/ETN offerings.

Vanguard Delivers

Vanguard is having a big year in the domestic dividend space. It has the largest and fourth largest domestic dividend ETFs in terms of assets. More importantly, those two ETFs have captured the top performance spots year to date.

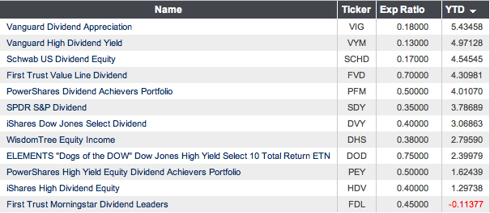

The massive Vanguard Dividend Appreciation ETF (VIG) has gained 5.43% this year, capturing the lead in peer group performance. The Vanguard High Dividend Yield ETF (VYM), with a peer group low 13bps expense ratio, takes second place at 4.97%.

Vanguard is clearly on a roll in the dividend ETF space in terms of performance, assets and fees. Those elements are a deadly combination for the other sponsors competing against them.

At the 4% performance mark are the rest of the top five domestic dividend ETFs: The Schwab U.S. Dividend Equity ETF (SCHD), the PowerShares Dividend Achievers ETF (PFM) and the First Trust ValueLine Dividend ETF (FVD). Here's the complete domestic dividend ETF universe ranked by performance via the Index Universe ETF Data Tool.

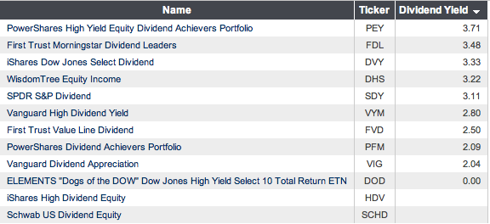

Dividend Yield

Dividend yield is a chief concern when evaluating dividend ETFs. Here's the current domestic dividend ETF yield chart from Index Universe. You'll see that two of the three worst performing dividend ETFs in 2012 (see chart above) are the largest yielding ETFs. Also of note is the top performer, VIG, sits at the bottom of this dividend yield chart.

Performance and Flows Don't Always Mix

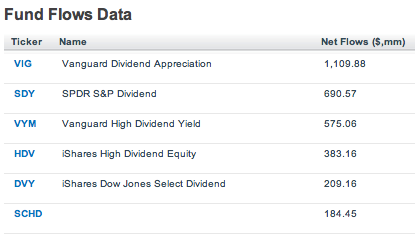

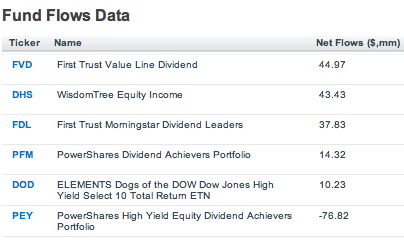

Taking a look at the year to date flows into these funds proves interesting as performance and inflows don't always go hand in hand. Here's two separate charts displaying the flows into all domestic dividend ETFs year to date from Index Universe's Fund Flow tool.

Notice Vanguard has gathered over $1.5 billion with its two top performing dividend ETFs which seems justified. However, the SPDR S&P Dividend ETF (SDY) is definitely overachieving this year as it has gathered the second most inflows, $690 million, even though it is only the sixth best performer of the group. Other notables include the iShares High Dividend Equity ETF (HDV), the second lowest performer of the group, has gathered the fourth largest amount of assets at $383 million. In contrast, PowerShares own High Yield Equity ETF, PEY, has outperformed HDV but has had an outflow of $76 million in assets, proof that inflows and outflows can be fickle.

Dividend ETF Leadership Rotation

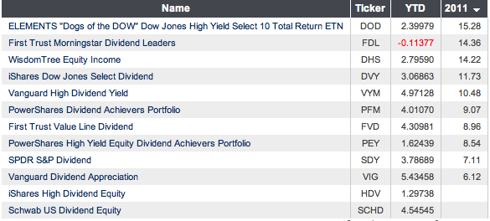

Looking back at 2011's performance chart is interesting as well. In fact it is almost the opposite of the 2012 performance chart in terms of leaders and laggards. Here's the domestic dividend universe sorted by 2011 returns.

Vanguard's VIG, in first place this year, finished last in 2011. First Trust's FDL, in last place this year, finished second last year. 2011's leader, DOD, is ranked eighth out of 12 ETFs in 2012. Clearly there is a rotation going on in the dividend yielding securities and sectors that the market is rewarding and thus different dividend ETFs are leading in 2012.

Conclusion

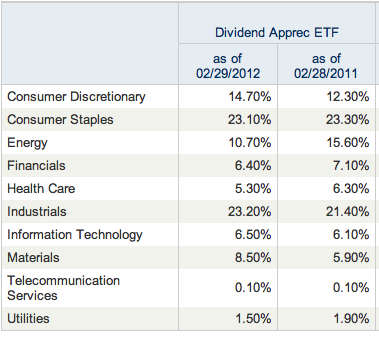

So what does the leading dividend ETF own in 2012? The answer for VIG is that it owns almost the same portfolio it did in 2011, with Consumer Staples and Industrials leading the way. Here's the most recent sector breakdown of VIG showing 2/29/2012 holdings versus 2/29/2011 holdings from Vanguard's website. I trust this chart will provide some further insight into successful dividend investing in 2012.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment