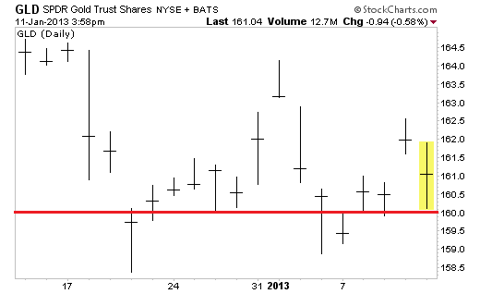

London, Jan.12, trading stocks .- My last article on gold proclaimed "The Song Remains The Same" for the maligned metal. It still does. Sure, I'm a little nervous. In that article I stated that if SPDR Gold Trust ETF (GLD) traded below $160.00, then the next stop would be $150.00.

By "traded below" I, of course, didn't mean once or twice -- I meant consistently. GLD has traded below that line. It's at $160.00 right now. But it's probably staying there. The ETF has closed below $160.00 several times in the past month, but keeps popping back over $160.00.

Click to enlarge images.

$160.00 is simply a psychological threshold that many traders are watching. So far, when GLD has traded below that number, enough buyers have stepped in and sent it back up.

Could it go lower? Absolutely. Next stop is still support at $150.00. And that's gonna bum me out if it does hit that number.

But it will come back.

You see, the fundamental story for gold has changed, but not the way many believe it has. The end of QE is not the death knell for gold. Ending QE simply provides an easy excuse for sellers to sell.

The principal and fundamental viewpoint of gold as an investment is different today than it was 10 or 15 years ago. Back then, no retail investors were asking about gold. None. Zero. Zilch. I know -- they were my clients. I remember looking at the gold fund my employer managed and its terrible returns thinking, "Who'd bother?"

I wasn't investing in gold 10 years ago. Most of us weren't. But the dollar meant something different back then as well. The dollar had cache; it didn't matter what it was or wasn't backed by. If you flew overseas and had greenbacks, you had bargaining power.

Not so much anymore.

Frankly, the decline in the perception of what a dollar represents has affected every currency. People around the world regularly question the safety and security of owning paper money instead of real assets. This fact alone will contribute to the price of gold not just maintaining, but increasing.

Yes, short-term myopics will argue that its going to drop to whatever price you imagine -- and it may. But, remember, it fell 30% in 2008. All the way back down to $700.00 per ounce. And you were making the same argument then.

The world has changed drastically since the financial crisis. It will never return to the way it was. Gold's status as an investment has changed as well, permanently, and for the better. ...

No comments:

Post a Comment