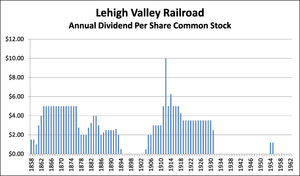

| English: Chart of the annual dividends on the common stock of the Lehigh Valley Railroad (Photo credit: Wikipedia) |

New York, Feb.26, stock advice .- Dividend-themed ETFs have been all the rage with investors looking to boost income in stocks rater than bonds. Meanwhile, an ETF focused on companies that are buying back their shares has outperformed the market by a wide margin.

Now, new research suggests that combining dividend and buyback strategies could result in a powerful and winning combination for ETF investors.

Chris Brightman is head of investment management at Research Affiliates, which manages indices that are used in PowerShares ETFs and Schwab mutual funds. He thinks stocks with the highest “total yield” – the added percentage of shares repurchased to the dividend yield percentage – are the best buys on the market, reports Shawn Tully for CNNMoney.

Brightman does not believe that dividends is the sole metric, so instead he looks at a value-oriented methodology that screens for dividends and the impact of stock buybacks.

Theoretically, if a company reduces its number of shares, for example by 1%, while keeping profits and the price/earnings ratio stable, the stock should see an increase of 1% in share price, he reasons.

Additionally, by combing for stable dividend sticks and companies that repurchase stocks, Brightman believes that these stocks could boost returns without venturing into volatile and risky firms. [Morningstar’s Model ETF Portfolio for Younger Investors]

While Research Affiliates is still developing a quasi-passive product based on Brightman’s ideas, ETF investors can approximate the strategy through dividend and buyback ETFs. [Dividend ETFs: Morningstar’s Top International Pick]

Some of the largest dividend ETFs include:

- Vanguard Dividend Appreciation ETF (NYSEArca: VIG): 2.24% 12-month yield

- iShares Dow Jones Select Dividend Index Fund (NYSEArca: DVY): 3.53% 12-month yield

- SPDR S&P Dividend ETF (NYSEArca: SDY): 3.08% 12-month yield

For buyback stocks, investors can take a look at the PowerShares Buyback Achievers Portfolio (NYSEArca: PKW). Additionally, the TrimTabs Float Shrink ETF (NYSEArca: TTFS) is an actively managed fund that focuses on companies that lower the number of shares outstanding. [Buyback ETF’s Five-Year Return Creaming the S&P 500] ...

No comments:

Post a Comment