| Cover of Up (Single Disc Widescreen) |

New York, May.7, national stock exchange .- First quarter earnings season is winding down. The news hasn't been that spectacular. Really, it's been just kind of "OK." Couple that idea with the weakening economic data coming out of the United States, China and Europe, and it seems out of line that the S&P 500 and the Dow Jones industrial average broke new all-time highs last week.

But what's interesting is that though investors may be finally moving from bonds to equities, they're not taking any risks. They're playing it safe and are staying risk averse. And that's created some eyebrow-raising notes...

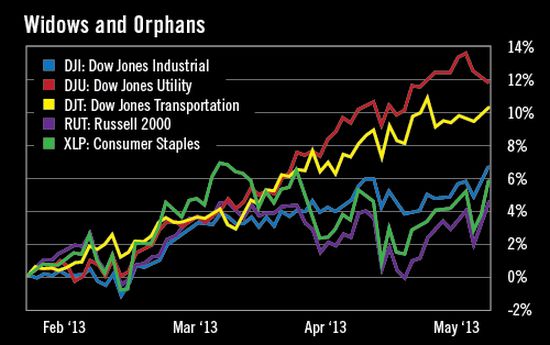

Leading the charge higher isn't high-growth stocks or more "risky" small caps. The Russell 2000 underperformed the S&P during the past month. And year-to-date, while the S&P and Dow are up over 13%, the Russell is up about 9%. That may not seem like much, but it continues to underline the prime thesis throughout the markets: Safety rules!

Last week, as the S&P 500 and Dow reached uncharted territory, U.S. Treasury yields on the 10-year hit 1.63%, their lowest level of the year. Let's chew on that for a second...

As the markets hit new records, demand for the safety inherent in Treasuries was on the rise.

The Cautious Bull

There's no better evidence of how cautious the bull has become than the fact "Old Lady" and defensive stocks are all the rage. Investors clearly want to get back into the market, but they're placing bets that a correction is imminent (or overdue), and they want downside protection.

Consumer staples, healthcare and utility stocks are on fire. Utilities are outperforming the broader indexes by several percentage points so far this year. And consumer goods are on a major tear.

For an example of a historical "safety play" that's soaring, we look toward Johnson & Johnson (NYSE: JNJ). Its shares are up 21% year-to-date, gaining 4.5% in the last month alone. Why that's intriguing is that from the start of 2008 to the end of 2012, shares of Johnson & Johnson rose a mere 5.32%... And during the five-year bull market from 2009 through 2012, shares gained a total of 16.58%.

Since 1992, Johnson & Johnson shares have averaged an annual gain of 9.23% gain, though the majority of that was from the glory days of the 1990s bull market. In other words, we're having a rally led not by innovation, but by "boring" companies.

Profiting on a Cautious Rise

Here's the deal. Boring can be beautiful... particularly in times of uncertainty. There are few market strategies that guarantee success year-after-year with undeniable results. But dividend stocks are about as close as you can get. Think of it like this: Dividend Aristocrats give you a 90% chance that your income will increase each year.

These are companies that have raised their dividends every single year for the past 25 years or more - the best of the best in terms of dividend payers. And the vast majority of them are companies we know well. Our homes are filled with their products.

At least a part of every investor's portfolio should be allocated to dividend stocks, specifically those classified as Perpetual Dividend Raisers. They provide stability. They hedge against volatility. And they act as the foundation of a portfolio that chugs ahead, year after year after year. The more time you have, the greater your returns will be.

Let's say we took $20,000 at the start of 2012 and split it among four fairly vanilla Dividend Aristocrats. Despite that these companies aren't doing anything innovative that we're going to brag about at a cocktail party, our investment outperformed the market. I selected four basic Dividend Aristocrats and used them as an example.

Here's what our $20,000 Dividend Aristocrat portfolio looks like:

Clorox (NYSE: CLX), Consolidated Edison (NYSE: ED), Johnson & Johnson (NYSE: JNJ) and Kimberly-Clark (NYSE: KMB) are far from extraordinary in terms of innovation and all-around "sexiness."

Clorox is best known for its household products, primarily bleach, Pine-Sol and Liquid-Plumr... Con Ed provides electricity... Johnson & Johnson makes shampoo, mouthwash, Band-Aids and tampons... And Kimberly-Clark's business is diapers, Kleenex and toilet paper.

You got to admit, not very "sexy." And a lot of bathroom products. But these are things we all need. The market is not going to go away. That's why these companies survive. Even better, in a little over a year, this portfolio has grown 31.65%. Our investment is worth $26,328 today. And, because we reinvested our dividends, the number of shares we own has grown 4.74%.

Since January 2012, the Dow gained 20.84%, while the S&P 500 rose 26.69%. Our strategy clearly outperformed the market. We don't always have to make fancy or sexy investments. Sometimes, the best investments are simply in the products people truly need, not smartphones or emerging technologies. As risk aversion continues to reign for investors, these dividend stocks are undoubtedly the best place to be.

No comments:

Post a Comment